How Does Cash Back On AP Spend and Vendor Bill Pay Work?

by Hari Viswanathan

As a controller or business owner, you probably have come across B2B AP payment platforms that offer cash back as an incentive to use virtual or physical debit cards for payments. These programs typically offer competitive cash back. Many programs also offer other benefits in lieu of cash back, like airline miles, and credit card points that could be used to get discounts or purchase gift cards and such.

A major benefit of these programs is that cash back often becomes a source of income for the company.

It transforms your AP department into a profit center.

Here’s how it works:

Instead of cutting a check or sending an ACH payment, the controller could elect to pay the vendor using a virtual or physical card through the Bill Pay network managed by the AP automation platform.

Many business operators wonder how these programs work and often assume that the vendor they do business with would somehow mark-up goods and services to claw back the rebates.

It can appear to be too good to be true – if they’re already used to pay the vendor by check or ACH, why would the vendor accept payment via a payment card that would effectively cut their bill? Surely, the vendor would find a way to hike the price of goods and services to cover the discount right?

Nothing could be further from the truth: Vendors want to get paid promptly and will often pay a discount on their invoices due in order to enable faster and easier payment.

Here’s why:

There’s a metric that vendors track and obsess over: Days Sales Outstanding (DSO)

DSO is a metric that measures the average number of days it takes a company to collect on payments due from its customers. This is an incredibly important metric for many Chief Financial Officers because it directly affects liquidity and cash reserves. This metric is so important that many broad-line vendors task their sales reps with collecting payment on orders taken from customers. In a time of economic uncertainty, minimizing DSOs is a priority for many CFOs.

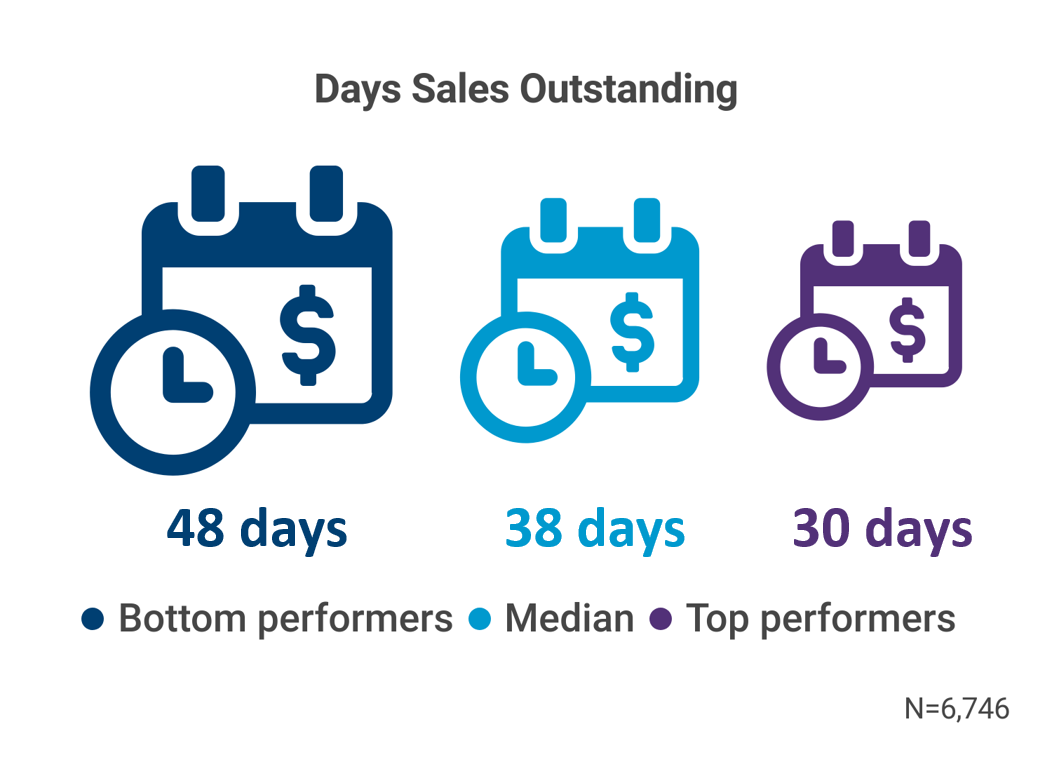

A survey conducted by APQC shows that top performing companies typically have DSOs of 30 days or less, while the median and poor performers typically get paid in 38 and 48 days respectively.

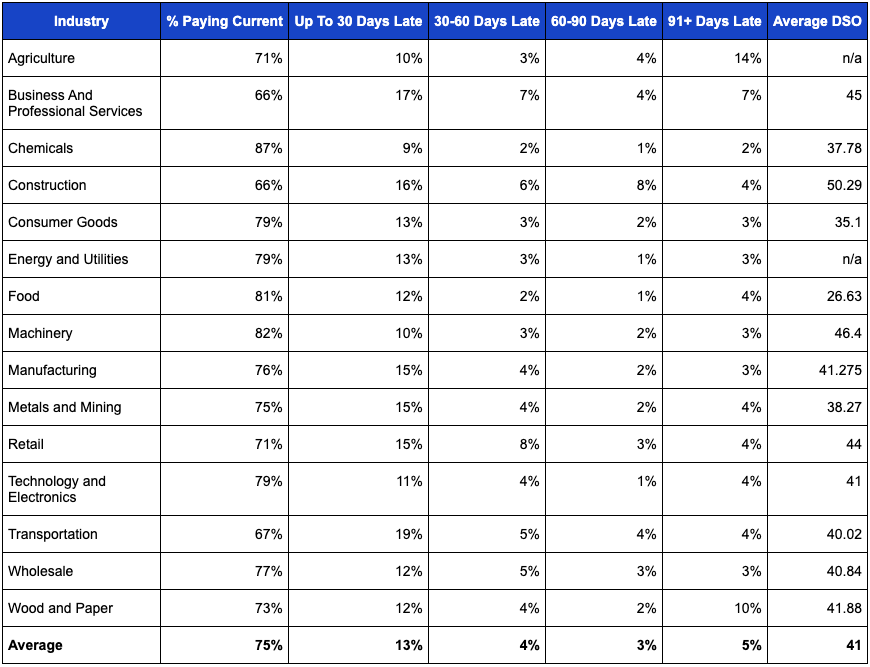

A benchmark study by Dun and Bradstreet also found that on average, only 75% of payers end up paying invoices on time (i.e. current).

The other 20% have invoices overdue by 30 to 90 days, and 5% have invoices overdue by 90+ days.

Here’s why so many vendors struggle with collecting on invoices in a timely fashion:

Manual invoice processing means that invoices take longer to be processed

As we’ve talked about in previous blog posts, manually processing invoices can take up to 90 minutes or longer depending on errors, level of line item detail and having to manually map to the right General Ledger (GL) codes. Manual data entry means that there’s a greater likelihood of incorrect entries, especially if there is a large volume of invoices to process. In order to make the process smoother, many companies try to batch up invoices to be processed (perhaps on a specific day of a week in a 2 week period) which doesn’t really solve the problem.

Mailing invoices and checks add an unpredictable step in the process that could add delays

Sending invoices and checks payments via mail often subjects them to mail delays. Unless the payer decides to send check payments with priority (this usually costs extra), many invoices arrive later than expected and so do checks.

For example, an invoice that is mailed out with a due date that starts on the date of mailing usually only arrives at the customers mailroom about a week later (assuming the invoices were mailed out on a Monday – if it’s sent mid-week, it could take longer). Now, since many companies have cut-off dates before checks are printed the invoice may only arrive after that cut-off date and won’t get processed until the next check run (this could be 2 weeks later or longer).

Company mailrooms that process inbound invoices often take a while to get to the invoice too – this adds another delaying step before the invoice is actually opened, manually keyed in and processed.

And once the check is mailed out, it is also subject to mail delays, as well as potentially getting misplaced in the mailroom or not getting cashed once received.

This round trip of checks and invoices could take at least 2-3 weeks in a good month. And that’s just for the mailing process!

This is why vendors are increasingly preferring digital payments over paper checks.

By paying vendors via ACH and credit cards, customers can get their payments to vendors quickly and bypass the mail altogether. Credit card payment networks also enable the vendor to receive payment immediately and acknowledge receipt.

The time to settle funds is also highly predictable, which is great for cash flow visibility.

An increasing number of vendors are accepting credit card payments. This is because unlike ACH, the credit card network verifies that that payor is within their credit limit, or has sufficient funds to pay the invoice – which means that the funds are guaranteed for the vendor receiving payment.

Conversely, ACH does not guarantee funds and payments can be delayed or rejected for many reasons including, but not limited to having insufficient funds, fraud, and so on. Since credit card networks perform a level of credit risk analysis, payments processed are generally much more reliable and predictable.

Vendors Are Willing To Pay A Fee To Get Paid Faster

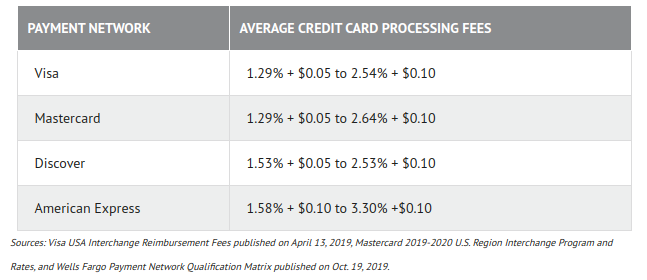

Vendors want to get paid faster and more reliably. That does mean that they are willing to pay for the privilege. For many payment networks, this fee is usually structured as a percentage of the transaction, plus a per transaction fee.

Here’s an example of payment network fees for the four major networks:

For a vendor, paying these fee is a no-brainer since they’re getting their DSOs under 30-days (from a typical 41-days outstanding).

For many vendor CFOs, this is a win-win deal as it

a) boosts their cash reserves and

b) enables them to plan their cash flow more efficiently.

Being Part Of The Bill Pay Network Cuts Vendor DSOs

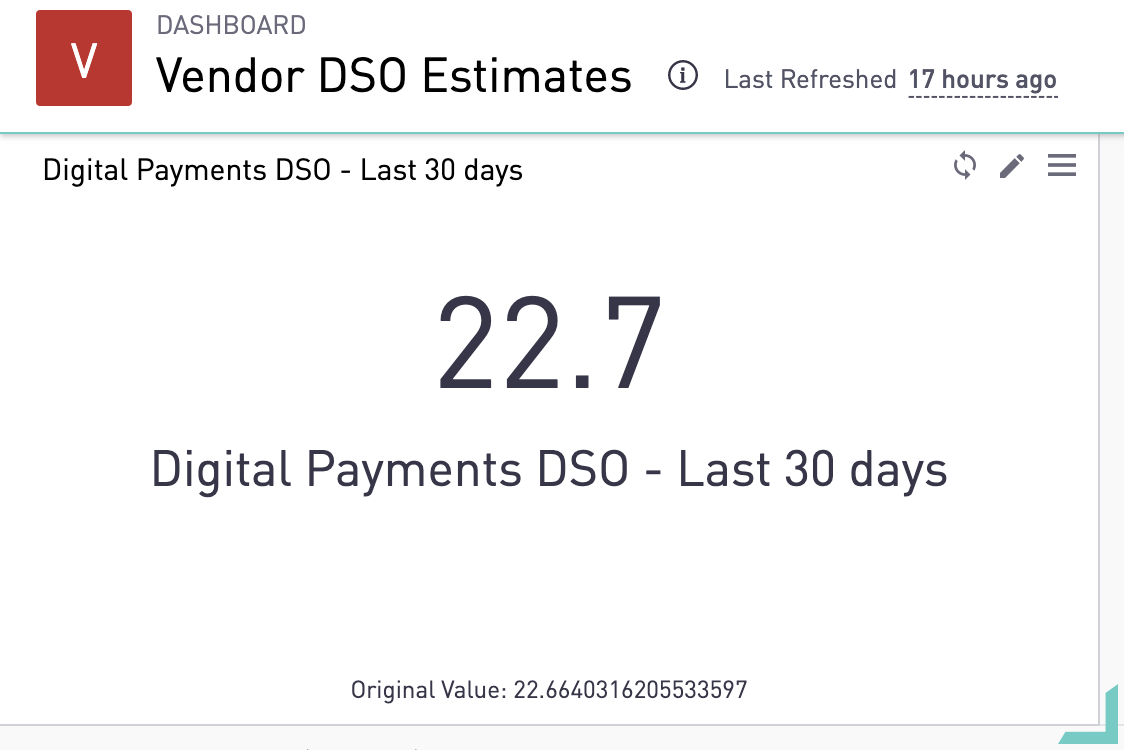

Ottimate helps customers pay their vendors digitally via our Bill Pay network. We performed a survey on our vendors and found that using Bill Pay improves DSO days considerably compared to the industry benchmark. In our survey we found that Bill Pay vendors enjoy DSOs of 22.7 days, compared to 41 days typically experienced by B2B vendors across verticals.

Automating AP and paying invoices digitally also enables customers to unlock early payment discounts. For example an invoice that has a 2/10 – net 30 terms means that a 2% discount is offered if the invoice is paid within 10 days, instead of 30.

Anecdotal research by IOFM conducted in the first half of 2020 also found that vendors are increasingly offering higher discounts of as much as 5%-7% while cash remains tight during the COVID-19 pandemic. This represents an opportunity for companies to get up to 8.9% in annual percentage savings through effectively capturing early payment discounts (according to research by the Aberdeen Group)

So How Do Customers Earn Cash Back on Bill Pay Spend?

Since payment processing is a lucrative business, payment networks incentivize customers to use their preferred cards by offering cash back that is taken out of the transaction fee charged to vendors.

In short, a portion of the processing fees that vendors pay to the Bill Pay network is passed back to the customer in the form of cash back. This is a truly win-win situation for all parties involved because:

- The payment network gets more customers to route payments through and grab market share

- The vendor gets paid faster, has better visibility on cash flow and cuts their DSOs on invoices due

- The payer transforms their AP department into profit center through cash back earnings

Switch to Ottimate VendorPay today and start earning cash back though our vCard Program

Using Virtual Cards (or vCards) to pay vendors in Ottimate’s Bill Pay network is a fantastic way to earn competitive cash back, pay vendors quickly and securely and capture any early payment discounts that might be available. For the benefits of Virtual Cards, check out our primer here

Ottimate offers vCard VendorPay right inside your invoice software. To see it for yourself, schedule a demo.

Stay up to date on the latest news in AP automation and finance

Related