Best Practices and Tips

AP Automation Guide

All companies have to do Accounts Payable (AP), but no AP process is identical to another. In this AP automation guide, discover the fundamentals of how AP works and the advantages it brings to businesses, with Ottimate as the AI tool that works tirelessly alongside your team.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Don’t Just Automate AP.

Ottimate It.

Working in accounts payable (AP) comes with several responsibilities that are critical to your company’s success. Your duties involve making timely invoice payments, fostering good vendor relationships, and monitoring expenses, among other tasks. Put simply: You are the gatekeeper of the goods and services your company needs to best serve your customers.

But like most finance teams today, AP faces labor shortages and budget constraints, forcing teams to do more with less. Whether you’re busy sifting through paper, keying data into your ERP, or chasing down signatures, there’s truly not enough time to tackle it all. And without proper support, your team may experience decreased productivity, lower job satisfaction, and higher work-related stress.

That’s where AP automation comes in.

Thanks to the magic of advanced technology, AP automation is designed to simplify your day-to-day tasks. Your team can shift from cumbersome manual processes and enjoy more efficient and cost-effective workflows. With streamlined invoice processing and coding, automatic approval routing, and easy payments and reconciliation, you can focus on activities that truly move the needle forward.

Whether you’re focused on day-to-day operations or financial strategy, AP automation can ease challenges and boost your efficiency, accuracy, and compliance. Dive into this guide to learn how AP automation can expand your team’s capacity and supercharge every step of the invoice-to-payment lifecycle.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Defining AP Automation’s Current State

AP automation is transforming how businesses handle their invoice and payment processes. But many organizations have yet to realize the full benefits of AP automation. Let’s take a closer look at the current state of accounts payable and where automation can have the biggest impact.

The Current Reality for Most AP Teams

While interest in AP automation has steadily grown, adoption remains low despite the time it’s wasting for companies. Research found that nearly 48 percent of all businesses handle up to 500 invoices monthly, and 66 percent report spending more than five days a month processing them.

On top of that, a recent survey found that among the respondents:

have fully automated AP workflows

have partial automation

don’t use automation at all

As you can see, the majority of respondents reported having partial automation (36 percent) or no automation at all (39 percent).

Processing invoices manually is also extremely time-consuming. The same survey showed 56 percent of AP teams spend over 10 hours a week just processing invoices, while 41 percent spend over 10 hours a week on supplier payments and maintenance. And a staggering 82 percent still key invoices into their ERP or accounting system by hand, wasting hours on data entry each day!

These inefficient processes create a tidal wave of avoidable problems.

AP teams ranked their biggest challenges as:

Despite these pain points, few companies have prioritized automation. In fact, the survey also revealed only 15 percent of respondents plan to implement AP automation within the next year, and about one in four respondents think it will take 3-5 years just to partially automate.

The gap between interest and action highlights how difficult it is to transform established-yet-broken processes. While automation could easily eliminate the bottlenecks, headaches, and drudgery AP professionals experience each day, manual AP methods continue to persist.

The Value of Automating Accounts Payable

Automating AP workflows provides immense value for finance teams. It eliminates tedious data entry and bottlenecks in the approval process. AP automation also extracts invoice data and maps it directly to your accounting system. This reduces human errors from keying invoices and speeds up processing times. With automated routing and personalized reminders, invoices no longer get stuck waiting for approvals. Payments can be initiated with the click of a button versus manual bank transfers.

Automation also makes the approver’s job easier. Using custom-built automation rules, you can route invoices to the appropriate person based on line-level invoice data. This ensures approvers only see invoices relevant to them. Real-time reporting provides the insights needed to confidently approve or decline spend.

For managers, AP automation delivers control, visibility, and time savings. It also helps with work distribution and bottleneck removal, while reducing administrative workload. For CFOs, accurate financials and detailed spend analysis supports better forecasting and strategic decisions.

Discover How AP Automation Benefited Tender Greens

When I started at Tender Greens, our AP department had three people. Today, even as our business grew from 17 to 24 locations, Plate IQ has cut our bookkeeping costs in half — and allowed us to move forward with an AP team of just one employee.

Sean Skuro

VP of Finance and Accounting, Tender Greens

Where AP Automation Can Have the Biggest Impact

To make the most of AP automation, it’s important to pinpoint where in the invoice lifecycle automation can have the most benefits.

AP automation tools should focus on invoice digitization, approval routing, payment automation, and accounting integrations to remove time-consuming steps that extend workflows.

By focusing on these critical areas, AP teams can transform productivity and efficiency. AP automation turns chaos into order, as it digitizes processes, optimizes approvals, and eliminates paper. This represents a crucial step forward for AP teams bogged down by manual tasks.

The Future of Accounts Payable is Here

The current state of AP automation reflects a broader trend: Digital transformation initiatives often leave core back-office teams like AP behind. But adopting AP automation software yields visible benefits and unlocks strategic, value-adding work. As more organizations realize this immense potential, AP automation will become the new normal.

To stay competitive, finance leaders must make AP automation a top priority.

Digitizing the information eliminates so many human hours. The information automatically ends up in both our accounting system and our inventory system. Now we have data at the meta level that can provide whatever information we need, when we need it, and that’s incredibly powerful.

Will Strong

Senior Advisor, Cherry Lane Ventures

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

How End-to-End AP Automation Works

End-to-end AP is the process of receiving, approving, and paying invoices. It typically begins with a purchase order request for supplies or services. Once items are received and an invoice is submitted, this prompts coding, approvals, payment, and reporting.

While the process may look different from company to company, most teams execute a few universal steps to complete the full cycle of AP processing.

With AP automation, you can streamline the entire AP process, from procurement to payment, with minimal human intervention. It goes beyond digitization; it automates — and thus optimizes — routine, error-prone tasks that commonly create bottlenecks.

Watch our two-minute explainer video to discover how the Ottimate AP automation streamlines the invoice-to-payment lifecycle, or keep reading.

End-to-End AP, by Ottimate

Here is a breakdown of the end-to-end AP process and how automation helps enhance every stage of the invoice lifecycle.

Procurement

The AP process begins with creating a purchase order (PO), and POs are typically created in your ERP or accounting system. AP automation software can automate this step. By using an AP solution with this functionality, you can make the procure-to-pay process more efficient by automating the generation and approval of purchase orders. Once PO items are received, the same tool can automatically match the PO to the corresponding invoice with minimal intervention.

Invoice Automation

Processing an invoice involves many steps: capturing the invoice from a vendor, coding line items to general ledger (GL) accounts, and matching supporting documents like purchase orders or receipts. AP automation streamlines these steps to reduce manual data entry and speed up the process.

1. Capture

Invoices are submitted in different ways, including email, fax, mail, and electronic data interchange (EDI). But receiving invoices from various sources and manually entering data into your accounting system can be confusing and time-consuming. AP automation software digitizes invoices regardless of the format or source, automatically capturing header data and line-by-line details with speed and accuracy, and centralizing your entire invoice management workflow within a single platform.

Most tools use optical character recognition (OCR) technology to “read” and extract data from invoices and convert it into a digital format. This method relies on queries and commands to recognize printed or handwritten text.

But while it’s effective, relying solely on OCR technology to process invoices leaves room for error and requires human intervention. That’s why the leading AP automation tools combine OCR technology with deep learning-based AI technology to not only read the data correctly, but also learn the structure of invoices and improve their understanding with every new invoice — so you can capture invoice data faster and with more accuracy.

2. Code

Once invoices are imported, the next step is to assign invoice items to the correct GL codes. Accurate coding is necessary to categorize financial data and analyze spend. Rather than relying on manual data entry, AP automation does the work for you, which improves data accuracy by automatically mapping each line item to your chart of accounts. This not only accelerates the coding process, but also reduces the risk of human errors and ensures more accurate financial reporting.

3. Match

When processing invoices, it’s important to match and reconcile them with supporting documents like purchase orders and receipts. That’s why most teams use a method called three-way matching to ensure there are no discrepancies between a PO and an invoice.

By automating your AP, you can bypass the manual effort required to match, review, and reconcile every invoice you receive. AP automation tools do the work for you, automatically linking each invoice to its PO and receipt by line item — whether the documents are stored in the tool or your ERP — and proactively detecting any discrepancies.

Advanced Routing and Approvals

Your approval process is likely complex and unique to your organization. And automating this step may feel like it requires extra flexibility and customization to best accommodate your team’s workflow. With AP automation software, you can build custom workflow routing and approval policies that automatically route invoices by vendor, GL, cost center, invoice amount, and more. Automation helps remove barriers in the process and improves your visibility into a critical step in the invoice lifecycle.

Payment Automation

Once invoices are approved, it’s time to pay your vendors. End-to-end AP automation streamlines payments, reducing errors and saving on payment costs. The latter can include expenses associated with paying vendors manually using envelopes and postage. By automating payments, you can pay any vendor from one platform, helping you avoid late payments and take advantage of early payment discounts. As a result, you can improve your vendor relationships and increase cost savings.

ERP Integration

At this point in the process, your invoices have been coded, approved, and paid with minimal human intervention. Now it’s time to export the payment information into your ERP or accounting system.

With end-to-end AP automation, your invoice and payment data seamlessly syncs with your ERP to keep data consistent across your accounting, purchasing, and other systems. Most AP automation solutions also provide an option to automatically import and export data into and from their system, further eliminating manual effort on your end.

Reporting

Ongoing reporting is crucial for maintaining accuracy in financial data and supporting auditing and forecasting. It also requires streamlined record-keeping to pull the necessary data for reports with ease.

With end-to-end AP automation, your AP process is consolidated in one tool, improving your visibility into the process with simplified access to data and critical insights into your operations. You can track key information like expenses, price fluctuations, vendor updates, and more. With most tools, you can even expect a comprehensive audit trail for all imported invoices, which helps your team report more quickly.

End-to-end AP automation is the key to speeding up your AP operations without sacrificing accuracy. By minimizing manual effort, you can boost productivity and empower your team to focus on more business-critical tasks. And with the right software, you can manage every step of the process in a single platform, providing key insights to further optimize your AP.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

AP Pain Points

Efficiency is key when it comes to accounts payable. Organizations count on AP teams to process invoices with speed and accuracy to minimize costs and maintain positive vendor relationships. Unfortunately, too many teams still rely on outdated practices — like entering data manually, writing checks, and handling physical records — that create inefficiencies in the process.

Without AP automation, these practices can create major friction points, including:

1. Slow Processing

Manually processing invoices is a tedious, multi-step task. It involves receiving an invoice from a vendor, coding and approving it, paying the bill, and entering it into your accounting system. Teams often use various methods to manage and track these steps — such as email, spreadsheets, and phone calls — which further delays the process. This can be a significant bottleneck if your AP team is expected to process a large volume of invoices each week.

2. Data Entry Errors

Mistakes are inevitable when AP teams rely on manual data entry. Not surprisingly, human error is one of the most pervasive issues in accounts payable, and it can be costly for your organization. Common errors include transposing numbers, miscoding an item, missing a decimal, and entering information in the wrong field.

Any of these small mistakes can lead to AP teams making duplicate payments or issuing payments for the wrong amount. Over time, these errors can add up and adversely affect cash flow, budgeting, and forecasts. They can also reduce productivity. Relying on human effort to find and resolve data entry errors takes up more of your team’s time and slows the process.

3. Matching Errors

In a similar vein, AP teams that rely on manual processes and practices are more prone to invoice-matching errors. These errors occur when there are discrepancies between invoices and the corresponding PO and receipt. If left unresolved, these errors can lead to duplicate or missed payments, payments issued for the wrong amount, and even fraud.

Three-way matching is the best way to mitigate these errors. But without automation, teams must manually investigate every mismatch, causing significant delays and even allowing some errors to slip through the cracks.

4. Physical Recordkeeping

One of the biggest barriers to efficient AP is the overabundance of paper. That’s why 38% of AP leaders prioritized reducing paper and manual tasks in 2023, according to a recent report. Receiving electronic invoices from suppliers — and storing digital copies in your AP automation system — can help your team avoid the following challenges:

- Visibility and Accessibility: It can be difficult to gain a clear view of the invoice lifecycle when storing physical records. Unfortunately, this hinders your team’s ability to gather key insights that could improve efficiency and reduce invoice processing time and costs. Paper documents are also typically hard to locate and access — especially if they’re stored in disparate locations — which may be stifling for remote or hybrid teams.

- Storage: It’s best practice for AP teams to keep certain financial documents on file for a certain period of time. Printing and filing every invoice your team processes, alongside other financial documents, means you’ll likely run out of space or have to resort to off-site facilities to store your records. Even worse, there’s a higher chance you will lose or damage these documents. This will only lead to less accessibility and visibility for your team.

- Security: Maintaining physical records also jeopardizes the security of your company’s financial information. Paper invoices are less secure, leading to a higher risk of theft, damage, or unauthorized access.

- Compliance: Tracking down paper invoices can make it hard to ensure compliance with certain legal or regulatory requirements. AP automation makes it easier to locate necessary documentation for audits and month-end closing, helping you save time and avoid operational issues like inaccurate recordkeeping, late payments, and increased risk of fraud.

Manual AP practices lead to inefficiencies in the process, costing your company time and money. Automating your AP process alleviates these challenges while helping your team operate more efficiently, eliminate errors, simplify compliance, and keep costs down.

Keep reading to learn best practices for integrating AP automation into your process and practical tips for finding the right tool for your team.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

Making automation a part of your AP workflow is like having a virtual assistant for your financial department. The right AP automation solution can help you simplify and accelerate your processes — eliminating the need for manually handling invoices, cutting and mailing checks by hand, and focusing on other time-consuming and error-prone accounts payable tasks.

Let’s explore the benefits of AP automation and walk through best practices and key steps to consider when choosing the right automation solution for your needs.

Benefits of AP Automation

AP automation can unlock substantial advantages for your business. With the right automation system or software, you can:

- Digitize and automate the entire invoice workflow: An AP automation system digitizes invoices and seamlessly guides them through a predefined approval workflow to extract and code line-item detail. This not only speeds up processing time, but also reduces the likelihood of errors linked to manual data entry.

- Facilitate payments and ERP integrations: Automation tools offer a variety of payment options, including ACH payments, virtual credit cards (or vCards), and even check payments. Integrating with your ERP system ensures you receive consistent and real-time payment information updates.

- Ensure business continuity: Automated AP promotes continuity by reducing dependency on paper-based processes. No matter where you are, your team can keep operations going with digital processes and remote accessibility. This makes your operations less susceptible to disruption.

- Decentralize and go digital: Automation allows you to decentralize your AP operations, which can be invaluable if your organization has multiple locations or a remote team. Going digital ensures that invoices and documents are readily accessible, giving your employees greater flexibility.

AP Automation Best Practices

Implementing best practices into your AP workflow can significantly improve your financial operations. By streamlining processes, reducing paper, and prioritizing security, you can greatly boost efficiency and accuracy:

- Streamline AP processes: Streamlining your accounts payable processes is essential. This involves creating clear approval workflows, standardizing data capture methods, and automating routine tasks. Automation, facilitated by an AP software, reduces manual labor and minimizes the risk of errors.

- Eliminate paper by embracing digital transformation: Processing physical invoices can lead to delays, mistakes, and additional costs. Transitioning from paper-based invoices to digital documents offers a highly efficient and eco-friendly solution.

- Prioritize data security: Robust security measures are necessary to protect sensitive financial data. Ensuring your data storage is secure, access controls are in place, and data is encrypted will help safeguard your financial details.

Choosing an Automated AP Solution

Finding the right AP automation software can feel overwhelming. Consider the following steps when choosing the best solution for your needs:

Implementing best practices in accounts payable, coupled with the right AP automation system or software, can significantly enhance your financial operations. Once you have the right tool in place, you can digitize and automate your invoice workflow, enable seamless payments, ensure business continuity, and embrace a more digital and remote-friendly work environment — so you can promote long-term financial well-being for your organization.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

AP Role Play: How AP Automation Benefits Each Person in Your AP Department

Accounts payable is the backbone of an organization’s financial operations, ensuring that bills are paid accurately, efficiently, and on time. Every role within your AP department plays a critical part in this process, while navigating their own unique responsibilities and pain points. Let’s explore some of the most common professional roles in AP — and how automation can benefit each of them.

AP Managers

An AP manager manages the accounts payable team and ensures smooth workflows by optimizing processes and procedures.

AP managers often grapple with high volumes of invoices, time-consuming manual tasks, and the need to maintain accuracy while meeting deadlines. They’re also under pressure to reduce costs and improve departmental efficiency.

AP Automation Benefits for AP Managers:

- Streamlined workflows: Automation simplifies and streamlines the entire invoice workflow, reducing manual data entry and the risk of errors.

- Improved oversight: AP managers gain real-time visibility into the status of invoices and can monitor team performance efficiently.

- Enhanced cost control: AP automation helps identify ways to save costs (like early payment discounts) and manage cash flow better.

- Reduced workload: Automation takes a load off AP managers by handling routine tasks, allowing them to focus on other aspects of their role.

→ Learn more about AP automation for AP Managers.

CFOs

A Chief Financial Officer (or CFO) holds the ultimate responsibility for a company’s financial health and strategy, including overseeing AP processes.

CFOs are charged with overseeing the company’s financial standing, ensuring compliance, and maintaining accurate financial records while striving for cost reduction and strategic growth.

AP Automation Benefits for CFOs:

- Enhanced visibility: AP automation provides CFOs with real-time insights into cash flow, liabilities, and financial performance.

- Reduced risk: By using automation, you can ensure that your team complies with financial regulations and avoids fraud or errors in financial records.

- Cost savings: By optimizing cash management and early payment discounts, AP automation can help CFOs save money.

- Strategic decision-making: Timely, accurate financial data allows CFOs to make informed, data-driven decisions.

→ Learn more about AP automation for CFOs.

Approvers

An approver is anyone responsible for reviewing and approving invoices. They ensure that expenses are valid, within budget, and comply with company policies.

Approvers often find themselves facing what feels like an endless stack of invoices to review. Manual paper-based approval processes are time-consuming and prone to delays — making it a challenge to ensure accuracy while meeting deadlines.

AP Automation Benefits for Approvers:

- Faster approvals: AP automation speeds up the approval process, allowing approvers to review and approve invoices with ease — even when they’re on the move.

- Access anywhere, anytime: With an automated process, approvers can access invoices from wherever they are, enabling a more flexible work environment.

- Reduced errors: Automation minimizes errors in data entry and provides visibility into the approval history.

- Compliance: AP automation ensures invoices meet company policies and regulations, reducing non-compliance risk.

→ Learn more about AP automation for Approvers.

Controllers

A controller manages a company’s financial reporting, internal controls, and compliance.

Controllers are concerned with the accuracy and integrity of financial data, compliance with regulations, and internal controls. They typically set and maintain adherence to financial policies, and face the challenge of reconciling financial data in a timely manner.

AP Automation Benefits for Controllers:

- Improved data accuracy: AP automation boosts data accuracy, which helps reduce the risk of errors — keeping your financial records clean and up to date.

- Compliance assurance: Automation ensures that invoices are processed in line with federal regulations and company policies, so your organization stays in compliance.

- Timely reporting: Controllers gain access to real-time financial data, making it easier to meet deadlines and provide accurate financial reports.

- Less manual reconciliation: Automation simplifies the reconciliation process, saving time and effort.

→ Learn more about AP automation for Controllers.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Invoice Automation

Invoice automation is transforming the way modern finance teams operate. Intelligent software helps organizations streamline invoicing processes, reduce costs, and unlock new levels of efficiency. Let’s explore best practices for invoice automation and dive into how leading solutions can optimize your accounts payable workflows.

What is Invoice Automation?

Invoice automation refers to using technology to digitize, code, route, approve, reconcile, and pay supplier invoices. It aims to eliminate the need for manual data entry and physical paperwork by automatically capturing critical information from invoices and facilitating approvals and payments.

The core components of an automated invoicing system include:

- Invoice Capture: Digitizing paper or electronic invoices and extracting key data using OCR and AI technologies

- Workflow Automation: Intelligently routing invoices to approvers based on custom rules and automating notifications

- Integrations: Connecting the system with ERPs, like NetSuite, Acumatica, and Dynamics, to sync invoice and payment data

- Approval Management: Allowing approvers to review invoices and supporting docs online and approve with a click

- Reporting & Analytics: Providing real-time visibility into AP metrics like invoice aging and cash flow

- Storage: Maintaining a searchable, digital filing cabinet of invoices and documents

Benefits of Invoice Automation

Using invoice automation can lead to a number of benefits for your organization. First, the technology can accelerate data capture, routing, and approvals, allowing for faster invoice processing. When paired with real-time reporting, this increased speed gives insights into accounts payable workflows. Additionally, systemizing workflows and approvals boosts compliance by ensuring proper oversight.

Invoice automation also reduces manual work and cuts down on paper and postage costs, leading to significant cost savings. Another advantage is that automated data extraction reduces human error to enhance accuracy. Finally, streamlined automation enables on-time payments, strengthening your vendor relationships.

Organizations that implement invoice automation can realize faster processing, increased visibility, improved compliance, cost savings, enhanced accuracy, and better vendor relationships.

We’re not spending a lot of time on every single invoice, having to code every single line item. Before, I was probably spending 15 to 20 hours a week just trying to get things to work right. And now, I go in every morning or afternoon for about half an hour to 45 minutes. So it’s definitely cut a lot of my time out there!

Mary Herrington

Accounting Manager, West Harbor Healthcare

Key Features of Leading Solutions

Modern invoice automation solutions, like Ottimate, offer advanced capabilities that streamline and improve your invoicing process. These solutions utilize AI and machine learning, with next-generation optical character recognition technology that uses AI to “learn” and adapt to different document types and formats over time, improving coding accuracy.

Specialized algorithms also enable features like Ottimate’s Instant Capture, which digitizes and codes invoices upon upload for immediate processing. These systems capture granular, line-item invoice details for deeper analysis and coding. And they provide digital filing cabinets to store invoices, documents, and data digitally for easy access and reference.

Rules-based workflows allow flexible routing of invoices according to approver type, amount, GL code, and other criteria. Bidirectional syncing integrates the automation system with ERP platforms that share invoicing data, while robust reporting capabilities give you real-time metrics and cash flow insights. Finally, supplier management features centralize supplier data, like contracts, for straightforward access.

With these advanced capabilities, modern solutions like Ottimate optimize and simplify your organization’s entire invoice automation process.

Implementing Invoice Automation

When rolling out a new invoice automation system, it is important to follow best practices to ensure a successful implementation. First, clearly define the objectives, including the specific challenges automation will solve and metrics of success. Build a detailed business case that lays out costs versus the projected return on investment.

Early on, get buy-in from key stakeholders in accounts payable, IT, finance leadership, and end users. Assess current workflows, map out invoice processes, and identify areas for improvement. Establish system governance by determining administrators, user roles/permissions, and protocols. For consistent recordkeeping, integrate the automation solution with core platforms like your ERP.

To ensure streamlined adoption, provide training to employees on using the new system. Continuously review results and fine-tune workflows over time to optimize processes. Finally, utilize the reporting capabilities of the automation system to track KPIs and assess value.

Following these best practices will lead to a smooth rollout and maximize the benefits of invoice automation.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Making Approval Workflows Work for You

One of the biggest obstacles in accounts payable is getting invoices approved efficiently. Routing invoices to the right people at the right time is critical for making payments on time and maximizing early payment discounts. However, convoluted approval processes that rely on email or spreadsheets often lead to delayed approvals, missed discounts, and frustrated staff.

An AP automation solution gives you the power to customize approval workflows and optimize the entire invoice approval process. Rather than forcing you into rigid predetermined rules, the right software offers flexibility to configure approval workflows aligned to your business needs.

Benefits of Automated Approval Workflows

Automating the approval process with customized workflows provides multiple advantages including:

- Faster approvals: Automation routes invoices to approvers instantly, rather than getting stuck in their inbox. Approvals can be made in a single click, meaning no more typing approval statements or printing/signing.

- Consistent rules: Pre-configured rules ensure invoices get routed the same way every time. There’s no guessing who needs to approve each invoice or which rules apply.

- Enforced policies: Invoice approval policies and limits are consistently enforced without reliance on staff knowledge.

- Audit trails: Every approval action is tracked and recorded for reference and easy auditing and reconciliation.

- Visibility: Managers can view the real-time status of invoices as they move through the process, making obstacles and workflow delays more apparent.

- Easier delegation: Approvers can assign control when out of office, so invoices keep moving.

We use approval rules to implement those policies in Ottimate. Instead of walking paper invoices over to the right person’s pile, we just load everything in and the system routes the invoices to the right approvers.

Danielle Sauce

AP Team, B&G Food Enterprises

Creating Customized Approval Workflows

Effective approval workflows share several common attributes:

- Stage-based routing: Invoices move through various stages on the way to final approval. For example, an initial review, secondary approver, and final accounting approval.

- Rules-driven paths: At each stage, rules determine the approver based on invoice attributes like total amount, vendor, GL codes, cost center, etc.

- Conditional logic: More advanced workflows branch conditionally, based on things like invoice amount thresholds, vendors, or GL codes.

- Approver delegation: Approvers can assign proxies to approve on their behalf when out of office or overloaded.

- Automated escalation: Ottimate automatically escalates an invoice to the next approver if it is not approved within a defined time period.

- Real-time tracking: Dashboards and alerts show approvers their pending invoices and track issues and discrepancies.

While most AP automation tools allow basic approval workflows, the flexibility to handle complex logic is key. Your system shouldn’t limit or complicate the rules you can configure. Non-technical users should be able to easily create workflows that align with your business requirements using intuitive workflow builders.

Key Features of Automated Approval Workflows

Advanced AP automation tools provide robust features to optimize invoice approvals:

- Unlimited approval stages: Set up as many sequential approval stages as needed to match existing policies.

- Conditional routing rules: Route to different approvers based on any invoice data, like amount, vendor, GL codes, job, location, etc.

- Complex logic: Support “if/then” decision branches, exclusive OR conditions, and more.

- Flexible escalation: Escalate stalled approvals based on custom time periods by user or stage.

- Approver delegation: Let approvers assign proxies or replacement approvers as needed.

- Mobile approvals: Manage approvals from anywhere via mobile apps.

- Approval analytics: View approval metrics and bottlenecks to optimize the process.

- Zero-touch approvals: Configure rules so certain invoices auto-approve with no manual intervention.

The right automation software won’t limit how you configure approvals. The system adapts to your processes rather than the other way around.

Ottimate’s flexible approach simplifies your workflow, maximizes early payment discounts, and ensures vendor satisfaction.

Getting Started with Automated Approvals

Transitioning from disjointed, manual approval processes to optimized, automated workflows powered by AI and machine learning technologies delivers game-changing efficiency. Take note of these tips to ensure a successful implementation:

- Document existing processes: Map out current approval steps, stakeholders, rules, and pain points.

- Define key requirements: Determine must-have functionality, like routing logic, escalation, and analytics.

- Build workflows in phases: Start with simple rules, then add conditional logic and custom enhancements.

- Train approvers: Demonstrate the new automated process and how each person’s role works within it

- Tweak as needed: Monitor adoption and continue refining workflows to discover what works best for your team.

- Track benefits: See metrics like reduced approval times, discounts captured, and vendor satisfaction.

Transforming invoice approvals from disorganized chaos to streamlined workflows powered by AP automation saves time, money, and frustration. Designed correctly, automated approval processes can optimize one of the biggest bottlenecks in accounts payable.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

The Power of Payment Automation

Time is money, and efficient processes and workflows are key to your organization’s financial success. But managing financial transactions can be a complex and time-consuming task. Payment automation can help.

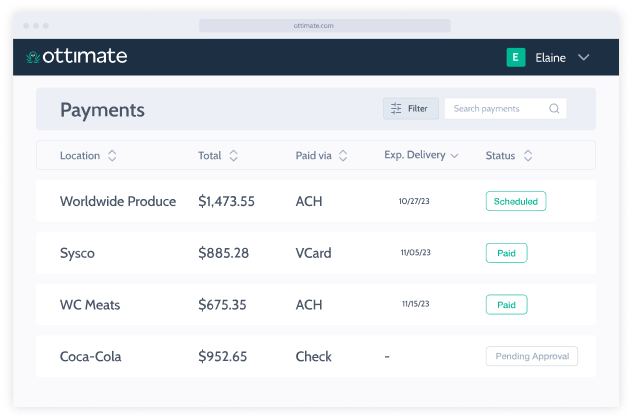

Payment automation refers to the process of using technology to streamline and manage your company’s payments. Implementing automated payments helps you save time, reduce costs, and ensure that your financial records are always accurate and up-to-date. Payment automation is a game-changer for businesses looking to improve efficiency, accuracy, and cost-effectiveness in their financial operations.

And with Ottimate, you have a powerful tool at your disposal to take your fiscal operations to the next level.

The Benefits of Payment Automation

You likely engage in many transactions with suppliers and vendors, which can quickly become overwhelming when done manually. By taking advantage of automated payments, you can ensure that you process every transaction efficiently, accurately, and on time. This not only streamlines your workflows, but promotes stronger and longer-lasting relationships with your vendors.

Let’s break down how payment automation can support your business:

- Time savings: Say “farewell” to the tedious task of manually processing payments. Automated payments not only save you time, but also help reduce the likelihood of costly human errors.

- Cost efficiency: Switching to automated payments eliminates the need for paper checks, envelopes, and postage, so you’ll save money on time and supplies. This also means you’ll avoid late fees and additional expenses often associated with manual payments.

- Improved accuracy: Automation eliminates the risk of human errors, including miscalculations or data entry mistakes. You’ll enjoy more accurate record-keeping, making it easier to keep up with tax regulations and reporting requirements.

- Enhanced security: Payment automation systems are designed with robust security features to protect your sensitive financial data. This reduces the risk of fraud or unauthorized access, giving you and your team peace of mind.

- Streamlined record-keeping: Automated payment tools maintain detailed records of all transactions, simplifying auditing and analysis. This is invaluable for decision-making and financial planning.

Ottimate is a great application that will assist in organizing your accounts payable & streamline the payment process. If you are looking to open up your available time to be productive in other areas of your business, then I would definitely suggest looking to Ottimate.

David H.

G2 Verified Mid-Market User

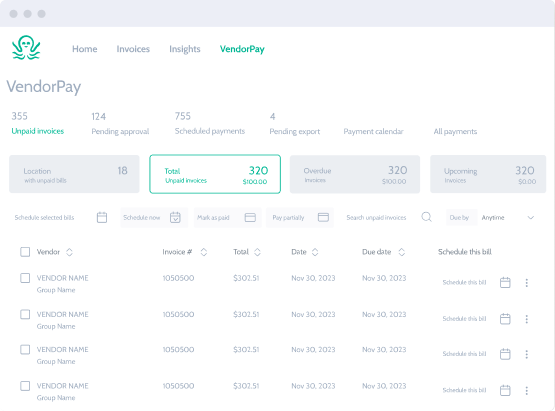

VendorPay: Your AI-Powered Payment Partner

Ottimate’s VendorPay is a cutting-edge solution designed to simplify and optimize your payment processes. With its user-friendly interface, you can set up, manage, and track your payments with ease. It offers a range of features such as invoice scanning, multiple payment options, and customizable payment schedules to meet your business’s needs.

When you take control of vendor payments with VendorPay, you’re ensuring strong supplier relationships and maximizing early payment discounts. VendorPay keeps you updated in real-time, so you can stay informed about your financial transactions and avoid surprises. Plus, it integrates seamlessly with your existing ERP or accounting software, making the transition to automation hassle-free.

Streamlining AP Automation through Digital Payments

In today’s fast-paced, tech-driven world, digital payment options have transformed how we handle transactions. The convenience and efficiency of digital payments make them a top choice for businesses and individuals alike.

Digital payments encompass a wide array of electronic financial transactions, which offer a swift and headache-free alternative to traditional payment methods like cash and checks. These payment options have become increasingly popular because of their simplicity, security, and speed.

There are two main types of digital payments: ACH payments and virtual credit cards.

ACH Transfers: The Cornerstone of AP Automation

ACH transfers are a pillar of AP automation. ACH (which stands for Automated Clearing House) payments facilitate electronic fund transfers from one bank account to another, offering a secure and efficient way to manage financial transactions — especially for businesses.

When it comes to AP automation, ACH payments help you:

- Simplify invoice payments: ACH enables businesses to make payments to suppliers, vendors, and service providers securely — and with no physical checks. This simplifies the invoice payment process.

- Promote cost-effectiveness: ACH transactions are often more cost-effective than check payments, which can save your company money by reducing overhead.

- Streamline reconciliation: ACH transactions are easy to reconcile, making it simpler for you and your team to track and manage company expenses.

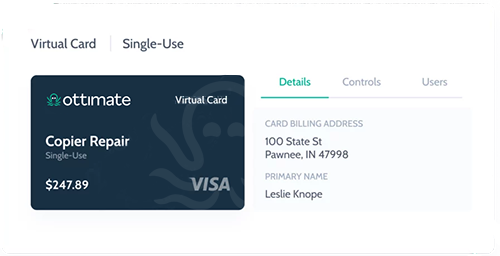

Virtual Cards: The Secure Solution for AP Automation

While ACH is a reliable tool for accounts payable automation, virtual cards offer an extra layer of security and control in managing payments.

A virtual card — or vCard — is a randomly-generated single- or multi-use credit card number that’s linked to your credit card account. vCards are generated for specific amounts, which can be used for any type of online payment, from online store purchases to bill and invoice payments.

Virtual cards enhance AP Automation through:

- Enhanced security: Since they’re generally designed for one-time use, vCards significantly reduce the risk of fraud or unauthorized charges. This offers an added layer of security with every transaction.

- Precise control: With virtual cards, you can set spending limits, expiration dates, and other parameters — giving you greater control over your expenses.

- Simplified supplier payments: Virtual cards allow you to pay your suppliers with ease, while minimizing the risk of fraud or misuse. This makes them an excellent solution for supplier payments.

- Simplified reconciliation: Virtual card transactions are easy to track for a smoother and more efficient reconciliation process.

Choosing the Right Digital Payment Type

Your business priorities and preferences will determine whether ACH or virtual cards are better for you.

ACH is the preferred option for:

- Streamlining day-to-day financial operations and reducing costs

- Ensuring a cost-effective and efficient solution for routine financial transactions

- Handling recurring payments, such as rent, utilities, and employee salaries

vCards are the ideal choice for:

- One-time or limited-use transactions, such as supplier payments or contract services

- Businesses looking to enhance security and control over their payments

- Minimizing the risk of fraud and unauthorized charges

Accounts payable automation is revolutionizing the way businesses manage their financial operations. Businesses can simplify payments, cut expenses, and improve security by using payment methods like ACH and virtual cards.

Spend Management: Taking Expense Management to the Next Level

Ottimate goes beyond invoice and payment automation by offering expense management tools.

Ottimate’s Spend Management solution empowers you to digitize expense tracking across your organization. You’ll benefit from greater visibility into and control over company spend, improving budget management while making it easier for staff to manage expenses.

And with the Ottimate Card, you can issue single-use virtual corporate cards for any employee expense — eliminating manual expense tracking entirely!

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Integrations Made Easy

One of the key benefits of AP automation software is the ability to integrate with your existing ERP or accounting systems. This eliminates duplicate data entry and ensures your financial records stay up-to-date automatically.

Ottimate offers some of the deepest and most advanced integrations in the industry. Our flexible API-based integrations keep your systems in sync in real time —with no need to manually backfill or export/import data.

Seamless Integration That Learns Your Systems

By using AI and machine learning technologies, Ottimate can adapt to your workflows and chart of accounts. Our integration agents “learn” how to intelligently map invoice data into your ERP or accounting software based on your unique configuration, with no complicated setup required.

As new invoices flow through Ottimate’s AP automation platform, our AI automatically syncs line-item details, vendor information, and other key data points to the corresponding records in your accounting system. You’ll be able to see approvals, payments, and other actions taken in Ottimate reflected in real time.

Ottimate acts as an extension of your ERP or accounting software, keeping everything up-to-date automatically through the intelligent integration. The result is a truly unified environment with no siloes or gaps between your systems.

Mapping Granular Details

Many basic accounting integrations only sync high-level invoice details like total, vendor, and date. Ottimate goes much deeper, mapping granular line-item data like:

- Item descriptions

- Quantity and rate

- GL codes

- Classes and departments

- Inventory details

- Billable status

This enables robust reporting, job costing, budgeting, and other advanced capabilities by harnessing the detailed data within your invoices.

Flexible Configuration Options

Ottimate integrations provide endless configuration options to meet your unique needs:

- Map data to custom fields in your accounting system

- Set up custom approval routing rules and hierarchies

- Configure automated GL coding with validation rules

- Sync custom transaction types

- Control which data fields flow between systems

No matter how varied or intricate, Ottimate can handle complex data structures in your chart of accounts with real-time syncing.

Access Source Documentation

A key challenge with many accounting packages is that the original invoice details get lost once imported. Ottimate preserves the original invoice document and lines up the source voucher in your ERP for reference.

Simply click any transaction within your accounting system to instantly view the original invoice PDF along with all line-item mappings and details. This creates clear visibility into where the data originated for easy auditing.

Real-Time Sync Eliminates Backfilling

With some AP automation tools, data needs to be exported and manually backfilled into your accounting system if the integration fails or breaks. Ottimate eliminates this headache by continually syncing data in real time.

Our intelligent integration agents monitor activity across systems and automatically push updates in both directions to prevent gaps — so you never have to worry about stale data or messy manual backfilling again.

Seamless Integrations with Leading Systems

Ottimate offers pre-built integrations with over 25 of the most popular ERP and accounting options payment systems to meet your unique needs. More are added all the time based on customers’ needs.

Some of our most widely-used integrations include:

- NetSuite: Real-time syncing with NetSuite ERP. Maps key details like transactions, vendors, items, projects, and more

- QuickBooks: Bi-directional integration with QuickBooks Online and Desktop editions. Syncs invoices, vendors, payments, and data

- Sage Intacct: Maps invoices and details into Sage Intacct in real time. Links transactions back to original source invoices

- Microsoft Dynamics: Keep Dynamics GP, NAV, and 365 up to date automatically by syncing invoices, vendors, and payments

- SAP: Integration adapters for SAP Business One and S/4HANA. Syncs invoices, vendors, GL codes, and inventory

- Acumatica: Acumatica Cloud ERP integration pushes AP data into your system automatically upon approval

- Budgeting systems: Connects with Adaptive, Anaplan, and other planning systems to harness AP data

No matter what ERP, accounting, or payment packages you use, we likely support it out of the box or can build a custom connection using our flexible API.

Some of the vendors we work with don’t have any kind of feed into NetSuite. We liked the setup and the ease of that connection — really the simplicity of Ottimate in general.

Whitney Hamiter

Sr. Manager Cash & Banking, Cava

Get More From Your Existing Systems

Ottimate connects your accounting software and other systems together into one smooth workflow. This stops duplicate work between systems. It also prevents mistakes from manually moving data between them.

With everything connected, you get the full benefit of your accounting software. All the data flows between systems automatically. This gives you better reporting and insights. Ottimate takes care of the tedious busywork of keeping systems in sync. This frees you up to focus on more important tasks.

Top Integration Questions Answered

Selecting and setting up accounting integrations can be full of challenges and questions. That’s why we’ve compiled answers to some of your most common integration questions:

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Unlocking Versatility: AP Automation for Every Industry

In today’s dynamic business landscape, flexibility and customization are key. Professionals in every industry are always on the lookout for solutions that can readily adapt to their organization’s unique workflows. An advanced AP automation solution, like Ottimate, is built to meet your specific needs.

Ottimate can be customized to meet the demands of any industry, from restaurants and hotels to healthcare and construction.

Restaurants

Speedy invoice processing is essential in the fast-paced world of fast and fine dining. Ottimate adapts to the restaurant industry’s need for quick approvals and seamless payment processing. It offers features like easy integration with a variety of ERP systems and real-time expense tracking — ensuring an optimized financial experience for your restaurant.

→ Learn more about Ottimate for Restaurants.

Country Clubs

Country clubs require precise financial management in all areas of operation, from paying vendors to managing member dues. Ottimate can be tailored to accommodate these needs through custom billing and reporting capabilities, ensuring your expenses are managed with precision.

→ Learn more about Ottimate for Country Clubs.

Healthcare & Senior Living

The healthcare sector relies on meticulous record-keeping and adherence to regulatory standards. Ottimate can be customized to handle medical invoices, streamline payments for supplies, and even aid in contractor payroll — guaranteeing efficient financial processes across your facility.

→ Learn more about Ottimate for Healthcare.

Grocery

Grocery stores operate with high volumes and tight margins. Ottimate can be configured to efficiently manage large numbers of invoices, helping grocers automate the approval process, track expenses, and strengthen vendor relationships.

→ Learn more about Ottimate for Grocery.

Retail

The hustle and bustle of retail operations require swift invoice processing and expense tracking. Ottimate has tools that meet your retail business’ needs. This can include bulk invoice handling, automated data entry, and real-time reporting.

→ Learn more about Ottimate for Retail.

Manufacturing

Manufacturers have many needs, including managing various suppliers, ensuring timely payments, and controlling costs. Ottimate learns your processes and adapts to handle the intricacies of your manufacturing business — including supporting multi-supplier invoice processing, cost optimization, and seamless integration with production systems.

→ Learn more about Ottimate for Manufacturing.

Construction

In the construction industry, managing subcontractor invoices and project expenses is crucial. Ottimate helps you lay the foundation for efficient financial processing. You’ll experience streamlined payment processing, better project expense tracking, and greater financial transparency.

→ Learn more about Ottimate for Construction.

Hotels

Hotels generally deal with a multitude of invoices from suppliers and service providers. With Ottimate, your hotel operations can easily tackle high invoice volumes, automate payment approval workflows, and integrate seamlessly with your property management system.

→ Learn more about Ottimate for Hotels.

Accounting & Bookkeeping

Accountants and bookkeepers are essential to the financial process, and Ottimate can be a valuable tool to help them streamline client invoicing, expense tracking, and reporting. Ottimate can be customized to fit the specific needs of any client, so accounting and bookkeeping professionals can offer high-quality service that’s both accurate and efficient.

→ Learn more about Ottimate for Accounting & Bookkeeping.

Automotive

The automotive industry heavily relies on precise expense management, especially when it comes to vehicle parts, equipment, and services. Ottimate facilitates seamless invoice processing, ensuring accurate cost tracking and reinforcing stronger supplier relationships for automotive professionals.

→ Learn more about Ottimate for Automotive.

Real Estate

Things move fast in the world of real estate, and professionals face different challenges depending on their role — especially when it comes to financial management. Ottimate centralizes your AP process, making invoice processing, billing, and expense tracking a breeze. Whether you’re selling or managing property, or working with commercial or residential clients, Ottimate has you covered.

→ Learn more about Ottimate for Real Estate.

- Don't Just Automate AP. Ottimate It.

- Defining AP Automation’s Current State

- How End-to-End AP Automation Works

- End-to-End AP, by Ottimate

- AP Pain Points

- The AP Automation Advantage: Tips, Tricks, & Choosing the Right AP Solution for You

- AP Role Play: How AP Automation Benefits Each Person in Your AP Department

- Invoice Automation

- Making Approval Workflows Work for You

- The Power of Payment Automation

- Streamlining AP Automation through Digital Payments

- Integrations Made Easy

- Unlocking Versatility: AP Automation for Every Industry

- Harness the Power of AP Automation

Harness the Power of AP Automation

The benefits of end-to-end AP automation are clear. Automating routine steps in the AP process improves efficiency and productivity while boosting your bottom line.

When assessing the best AP automation software for your team, look no further than Ottimate.

Ottimate does more than digitize your AP. It deploys AI and machine learning throughout the invoice lifecycle, making your AP operations faster and more accurate over time. From invoice and payment automation to advanced approval workflows and seamless integrations, Ottimate is your one-stop shop for end-to-end AP automation, including:

- Capturing line-item data and allocating them to the correct GL accounts

- Routing bills to the right approvers

- Facilitating secure payments to any vendor

- Reconciling GL accounts and flagging discrepancies

- Syncing data with your ERP in real-time

See how Ottimate can work for your team!