AP Automation: A Game Changer for Cash Flow Management

by The Ottimate Editorial Team

It’s often said that the only constant in the realm of business is change. Navigating the fluctuating tides of commerce means balancing strategic foresight and real-time adaptability. The secret compass guiding you through these uncertain waters? Your cash flow management.

Balancing sheets and managing profit and loss statements play pivotal roles, sure. Yet, it’s your cash flow statement that stands as the crystal ball revealing your company’s financial health, both current and future. This is particularly crucial for businesses like restaurants or grocery companies where regular inventory purchases are the name of the game.

Here, we’ll take a closer look at how cash flow across your company reflects your current operations and also has a heavy impact on your future operations. Many factors can influence your cash flow statement’s usefulness, and thus, accounts payable (AP) automation can have an outsized impact on your cash flow accounting.

Decoding Cash Flow: The Business Lifeline

Let’s construct a familiar scenario:

The holiday season is on the horizon, and based on last year’s sales, you’re bracing for a busy period. But to ensure smooth operations during the rush, you need to stock up well in advance, even before the revenues from your sales roll in. Adding to this, the end of the year brings with it due loan payments, pushing your expenses further into the red zone.

Without strategic planning and savvy cash flow management, your business could be staring down the barrel of a financial conundrum.

This is where your cash flow statement rides to the rescue, offering a panoramic view of your business’s financial standing. It details the cash inflows (receipts/sales) and cash outflows (operational, investment, and financial expenses). In essence, it’s the heartbeat of your business, influencing sales, customer satisfaction, and even your team’s ability to perform skillfully.

(Want to learn more about some of your most important financial statements? Check out more information here.)

Common Hurdles in Cash Flow Management

Common accounting and accounts payable tasks, like managing cash flow, need to be completed regularly. Because cash flow is so detail-oriented yet predictable, generating cash flow statements is an ideal task for automating.

Building a reliable cash flow statement hinges on the accuracy and timeliness of data drawn from a plethora of sources. Among the most significant challenges here is managing this ocean of information without overwhelming your team. This necessitates robust accounting tools and well-thought-out strategies.

Further muddying the waters is the unpredictability inherent to traditional accounts payable (AP), particularly concerning payments. Despite having vendor payment terms spelled out in contracts, payment timelines can be irregular, causing havoc in your cash flow management. Lost checks, which can create delays, lack of transparency around invoice payment statuses, and other such inconsistencies can lead to unanticipated discrepancies in your books.

The Transformative Power of Invoice Automation

This is where the magic of AP automation and electronic bill payment comes into play, promising to dramatically reshape your cash flow management. They form a critical component in cost-tracking, such as inventory prices and changes in credit terms with vendors or distributors. Your AP data serves as a treasure trove of information for forecasting inventory levels based on demand.

Numerous major business decisions affect your overall cash flow. However, with all of the variables that overlap between AP and your cash on hand, it’s essential to review your AP solutions at the same time as your cash flow management.

Let’s delve deeper into how a tool like AP automation can bolster your cash flow statement.

Harnessing the Power of Data

In the data-driven world of modern business, the quality of data is paramount. Your invoice data needs to be accurate, timely, and digitized.

Cutting-edge AP solutions like Ottimate leverage the power of Optical Character Recognition (OCR) technology and machine learning. These tools can “read” invoices with increasing accuracy over time, learning and remembering details such as line item names, General Ledger codes, and vendor invoice templates.

But accuracy isn’t enough — data must also be current. With swift transcription times and the ability to scale with your business, AP automation ensures your invoice data is not only precise but also up-to-date.

Digitizing data creates a centralized, standardized repository that anyone can access from anywhere. All your invoices, whether paper, PDF email attachments, or electronic data interchange formats (EDI), are stored securely in the cloud.

More importantly, this digitized data is also indexed, standardizing the information and allowing you to leverage tools like search functions and exported reports to navigate through large amounts of invoice data effortlessly.

This results in a data set that is accurate, timely, and incredibly useful. With this information at your fingertips, you can improve everything from monitoring the cost of goods sold (COGS) to real-time profit and loss (P&L) information.

Customized Solutions for Complex Businesses

AP solutions like Ottimate are designed with the complexities of modern businesses in mind. If your business spans multiple locations or concepts, managing expenses and costs at the location or store level can be daunting. At the same time, you need to maintain a bird’s eye view of the financial situation across your organization.

Ottimate allows you to manage multiple P&L statements separately. This granular approach empowers you to make more accurate cash flow projections, drilling down into the specifics as needed.

The Age of Electronic Payments

A seismic shift from traditional methods like paper checks to electronic payments can have an incredible impact on your cash flow.

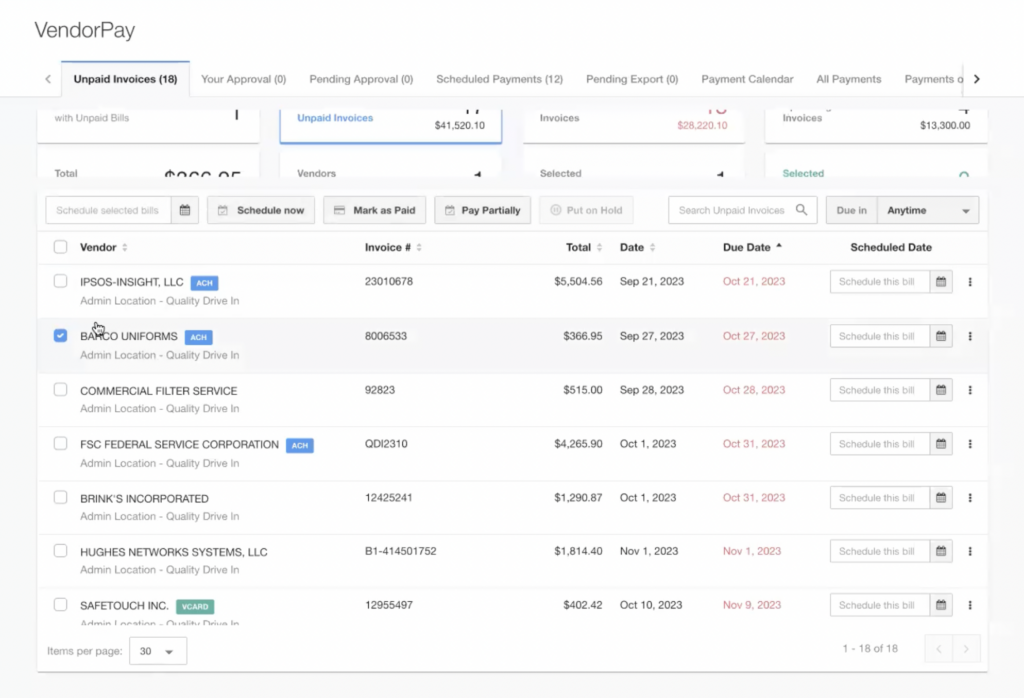

Electronic payments, like Ottimate’s VendorPay, provide comprehensive visibility into your vendor payments, all within a single, user-friendly dashboard. This real-time data access means you and your vendors can track the status of an invoice and payment at any given moment, facilitating proactive and accurate cash flow planning.

As Jessica Glenn, a bookkeeper at accounting firm Books To Go, succinctly puts it, VendorPay gives her clients more control over their cash flow. They decide when payments are sent, allowing them to effectively manage short-term cash needs. Additionally, vendors can view payment statuses in real time, helping to build and maintain strong vendor relationships.

“Bill.com always took funds when we initiated payment,” Jessica reported. “We love Ottimate [VendorPay] because you don’t take the money out of the client’s account until the check clears the bank, which helps the restaurants — especially right now, with their cash flow issues”.

Cash Flow Management and AP Automation: A Dynamic Duo

The pairing of cash flow management and AP automation is more than just a trend; it’s a transformative shift in how businesses handle their finances. By adopting automated solutions for your AP processes, your cash flow management strategy can soar to new heights.

Are you ready to see how invoice automation can revolutionize your business’s data and, consequently, your decision-making? Sign up for a free demo of Ottimate today and take the first step toward transforming your company’s AP automation and future.

Stay up to date on the latest news in AP automation and finance

Related