The AI Advantage in AP: From Touchless Processing to Strategic Profitability

by Hannah Khouri

For decades, Accounts Payable has been one of the most time-consuming, labor-intensive processes in finance. Stacks of invoices, hours of data entry, approval bottlenecks, and the constant risk of human error have long weighed heavily on finance teams.

Over the years, technology chipped away at the problem – from ERPS in the 90s to electronic invoicing in the 2000s. The rise of Optical Character Recognition (OCR) seemed particularly promising. But over time, it became clear that even OCR couldn’t fully address the inefficiencies of AP.

Now, artificial intelligence – specifically AI that’s purpose-built for AP – is changing that.

In this post, we’ll explore why OCR falls short, how AI goes further, and how purpose-built AI is transforming AP into a driver of efficiency, insight, and profitability.

From paper to OCR: AP’s first step toward automation

For many years, AP remained largely unchanged. Invoices arrived via mail, were stamped, routed for approval, and manually entered into ledgers – or later, into ERPs and accounting software. Even when invoices transitioned to digital formats in the 2000s, finance teams still had to enter data into systems manually.

OCR was the first real breakthrough. For the first time, software could “read” printed text, eliminating much of the manual entry that bogged down AP teams. Paired with template matching, which instructed the system on where to look for fields such as invoice numbers or totals, OCR powered the first wave of AP automation.

But OCR wasn’t a silver bullet. While it could see text, it didn’t have the intelligence to understand it. That meant it couldn’t distinguish between an invoice number and a PO number, struggled with handwritten notes or multi-page invoices, and broke whenever a vendor updated their format. Additionally, accuracy hovered around 70-80%, indicating that humans still needed to review, correct, and maintain the templates.

OCR was progress, but it wasn’t the breakthrough AP needed.

Why AI outperforms OCR

While OCR chipped away at AP inefficiencies, it never truly eliminated them. The rise of AI presented a big opportunity to go further.

Instead of simply recognizing characters, AI interprets them in context. For example, it knows the difference between a PO number, invoice number, and phone number – even though they’re all numbers. It can also automatically map line items to the correct GL code, adapt to new invoice formats without templates, and learn continuously from every interaction and correction.

The impact is dramatic. What takes humans 3-5 minutes per invoice, AI completes in seconds. Accuracy climbs into the 90s, which is far higher than OCR’s 70-80% range.

AI also addresses AP pain points that OCR cannot.

- Automatic GL mapping: Instead of manually coding each line, AI analyzes vendors, item descriptions, cost centers, and historical data to instantly apply GL codes – saving hours at close while ensuring consistency.

- Continuous learning: Every invoice processed makes the system smarter, reducing the need for templates and upkeep.

- Fraud and anomaly detection: AI flags duplicates, suspicious vendors, and unusual activity in real time.

- Smarter workflows: By learning approval hierarchies, AI automatically routes invoices to the right person, minimizing bottlenecks and ensuring timely payment.

With AI, AP isn’t just faster – it’s smarter, more reliable, and continuously improving.

Why general AI falls short for AP

It’s easy to assume “AI is AI.” But just as OCR has its limits, so too does AI – at least in its general-purpose form.

Popular models like ChatGPT, Claude, and Gemini are incredibly powerful. But they’re designed to be broad and versatile, not specialized. In other words, they’re not built for the complex needs of AP.

General-purpose AI can’t deliver the accuracy or depth that finance teams need. It struggles with nuanced scenarios like vendor-specific quirks or exceptions, and it falters when faced with unstructured data like handwritten notes or lengthy, multi-page invoices. Most importantly, it lacks the contextual understanding required to reliably capture, code reliably, and process invoice data at scale.

At the end of the day, general AI provides raw intelligence, but it takes specialization to make it truly work for AP.

Ottimate AI: The first AI engine built for modern AP

That’s why we built Ottimate AI – the first engine designed specifically for the complexities of AP.

Ottimate AI is more than invoice capture. It’s a complete layer of AP intelligence that helps finance teams work faster, smarter, and with greater confidence. From coding invoices to analyzing risks to supporting payments, Ottimate AI covers the entire invoice-to-payment lifecycle.

We’ve taken powerful frontier AI models like Gemini and hyper-tuned them with our own R&D and more than a decade of AP experience. Over the years, we’ve trained the system on millions of invoices, providing it with high-quality data necessary to master the nuances of finance. The result is an engine that not only recognizes data but truly understands AP – from mapping invoices to POs and vendor catalogs to assigning GL codes and surfacing insights in real-time.

With Ottimate AI, finance teams can:

- Get immediate answers to AP questions

- Make smarter decisions with quicker insights, leveraging data and visual cues

- Function at the highest capacity across all their locations by tracking data, approvals, internal team efficiency, and more

- Constantly monitor for anomalies, tell users where to prioritize, and suggest ways to improve margins and cash flow

- Build instant reports based on data and format requests

In short, Ottimate AI empowers finance teams to operate efficiently across every location, while reducing risk and unlocking profitability.

Driving productivity and profitability for finance teams

For finance leaders, the question isn’t about what Ottimate AI can do – it’s why it matters. The answer boils down to efficiency, accuracy, and profitability.

Ottimate AI handles the kinds of invoices and workflows that overwhelm traditional tools. It can process 50+ page invoices with 1,000+ line items, interpret handwritten notes, and match invoices against POs in seconds – tasks that would take humans minutes per invoice. Trained on more than two million invoices, the system continuously learns and adapts, eliminating the need for templates and manual upkeep.

The performance of Ottimate AI speaks for itself. It processes 95% of invoices instantly without human intervention and produces 99.5% header-level accuracy and 95% line-item accuracy, significantly outperforming even the most powerful generic AI models like Claude, GPT-4, and Gemini.

But the impact goes beyond speed and accuracy.

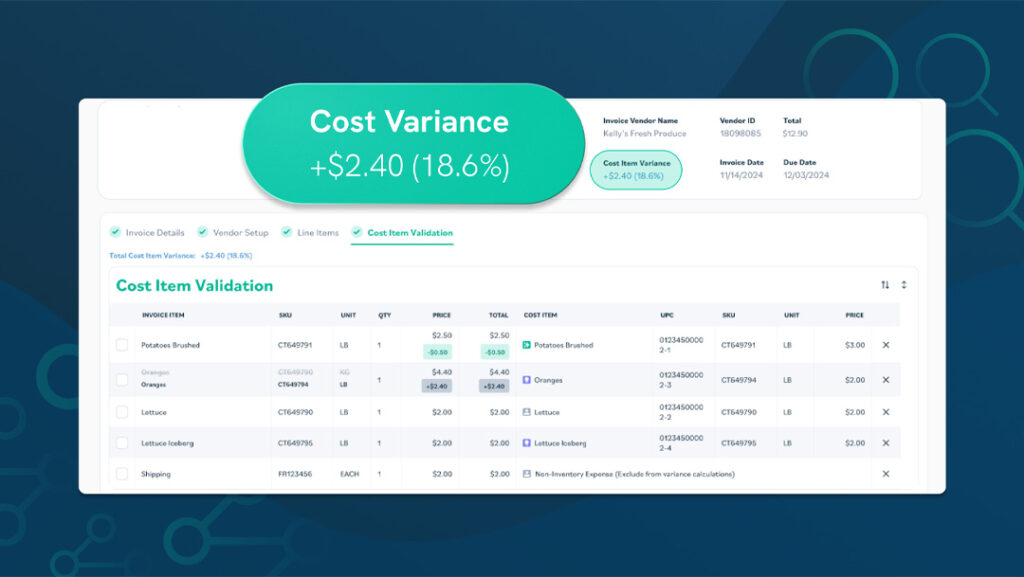

Ottimate AI actively improves profitability throughout the invoice-to-payment lifecycle. It captures and codes invoices precisely, flags cost discrepancies by syncing with your inventory, and prevents overpayments that shrink margins. It also reveals spend patterns and anomalies instantly (no spreadsheets required) so finance leaders can act on insights in real time. Additionally, with built-in reliability scoring, it identifies invoice risks before they impact your books, enabling you to prioritize reviews and prevent costly errors.

By combining intelligence with efficiency, Ottimate AI is transforming AP from a cost center into a profit driver.

Purpose-built AI: The next era of AP

AP has come a long way from paper invoices and manual entry. But true transformation is only possible with AI built for the unique complexities of AP.

By combining speed, accuracy, and continuous learning with real-time risk detection and margin protection, Ottimate AI transforms AP from a cost center to a profitability driver.

Ready to see our purpose-built AI Engine for yourself? Book a live demo today.