Why Corporate Cards Win Against Petty Cash

by The Ottimate Editorial Team

As a business owner, operator, or manager, you’re probably familiar with the scenario: you need to pay a vendor and they prefer petty cash or a corporate card payment rather than invoicing you. You have a way to handle invoices and sync that with your ERP, but the question is, how will these incidental payments end up in your ERP? You could respond to this scenario in two ways: using funds from your petty cash that you have on hand and then later enter the transaction information into your ERP manually or use a spend management solution that lets you pay with a physical card or virtual card that will automatically sync with your payments solution and ERP.

Keep reading this article to discover more about both options.

Using Petty Cash

Petty cash is a small fund of cash that your business securely keeps on hand, usually for everyday purchases, expenses, and reimbursements.

In this scenario, you may send your employee to the store with petty cash to purchase ingredients. According to your restaurant’s policy, they should save the receipt to turn back to the restaurant, so you can later validate the purchase, record it, and replenish the store’s petty cash if needed.

But say your restaurant didn’t have enough cash for the purchase. You may ask an employee like a manager to use their own cash. In this case, you would need the receipt to break down the expense and try to reimburse them as quickly as possible.

Eventually, if you’re using a cash system, your accounting team will need to reconcile the receipts from this purchase with the company’s general ledger (GL). If the receipt was from a smaller store that did not itemize purchases, your team may need to take extra steps to code properly to the GL. Hopefully your staff was able to keep track of the right receipts, so your accounting team can manually record the transaction and coordinate any reimbursement if needed.

Pros & Cons of Petty Cash:

Pros

- Can be spent almost everywhere, giving you flexibility when your store has an immediate need

- Fast way to deal with an inventory issue

Cons

- Purchases are limited by the amount of cash you keep on hand

- Fraud and security issues can be commonplace with cash systems. You need to monitor cash spend closely to ensure your employees use it only on the correct expenses.

- Tracking and reconciling petty cash spend can get messy, especially in a restaurant. It is easy to misplace documentation like receipts, or make mistakes manually keying in accounting numbers.

- When you have cash on hand, you need to keep the cash stored safely within the restaurant

- Because most patrons are now paying with credit cards, it can be difficult to maintain a petty cash fund in the restaurant. It’s easy to spend petty cash, but harder to remember to replace it — until the next time you really need it. Requiring the shift manager to run out to the bank to get cash can be time-consuming and risky (assuming it’s even during normal banking hours).

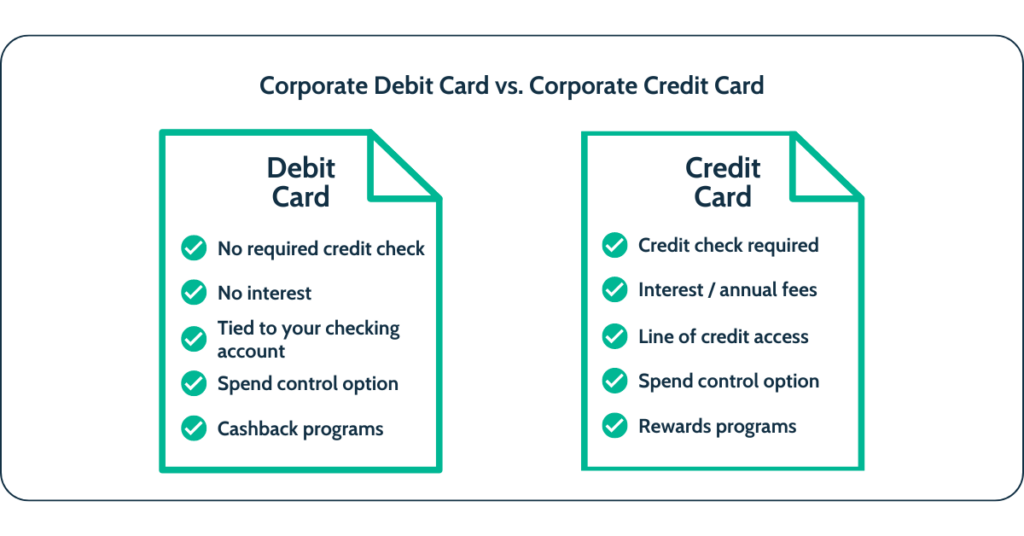

Using a Corporate Debit Card Instead of Petty Cash

A corporate debit card is a card specifically designated for your business. It functions the same way as a personal debit card, directly withdrawing from the balance of an FDIC-insured bank account. The business card is tied to your business account, and it can be used by your employees for regular expenses, supplies, or travel.

A corporate debit card like the Ottimate Card enables you to issue both physical debit cards and virtual cards. These cards can be specifically designated for certain employees, locations, or transactions.

In our hypothetical situation above, your employee would take the physical corporate debit card to purchase the needed items. Corporate debit cards are a quick and simple way to pay for expenses, but the benefits go beyond the ease of use. Here are some of the ways that a corporate debit card creates a seamless solution.

How Corporate Cards Serve as an Alternative to Petty Cash

Pros

Company credit cards or corporate cards are rapidly replacing petty cash in many businesses, offering several benefits that streamline expense management:

- Enhanced Monitoring: With company credit cards, businesses can track employee spending in real-time. This capability allows for immediate oversight and ensures that any unauthorized or incorrect expenses are flagged promptly.

- Discounts and Rewards: Many credit card providers offer attractive rewards programs, including cash back and discounts. These incentives can be advantageous for businesses, helping reduce costs and providing value back to the company with each purchase.

- Improved Cash Flow Management: Utilizing credit cards can aid in better cash flow management. Businesses can defer payment for purchases, which can keep cash available for other operational needs.

Cons

However, with these advantages come notable risks that every business should consider:

- Fraud Vulnerability: Sharing credit cards and PINs among employees opens up the possibility of internal and external fraud. Mismanagement or misuse by one individual could have financial repercussions for the entire organization.

- Overspending: Employees may inadvertently exceed spending limits or struggle to distinguish between essential and non-essential expenses. This risk highlights the importance of clear guidelines and spending policies.

- Security Concerns: Greater access to company finances means that data breaches or lost cards can pose significant security risks.

By weighing these pros and cons, companies can make informed decisions about integrating credit cards into their expense management systems, ensuring both efficiency and security.

Improved Security Through Card Controls

One of the biggest benefits of a corporate debit card is that most of these cards come with spend controls that you can adjust on the back end with the click of a button. These controls can help prevent fraud and ensure the card is only used for approved expenses.

Control Spending Limits: As an administrator, you can control the exact funds available to spend on your corporate debit card. The limit is adjustable, and it can be applied instantly to your card. For an employee going out to buy more of a certain ingredient, these pre-loaded policies can help ensure their spending stays within designated guard rails.

Control Spend Category: Each individual card can also leverage Merchant Category Codes (MCC) to place helpful restrictions around business spending. A MCC is a four-digit number, assigned by financial institutions, to different kinds of businesses. By assigning certain MCC codes to your corporate card, you can customize the spend categories where your staff can use the card. If your staff is picking up more ingredients for that night’s service, you may have a physical card on hand that can only be used at retailers with the MCC for grocery stores (5411). With these parameters, MCC codes can help prevent non-business-related purchases and also help you document the digital transactions.

Overall, the controls that come with a corporate debit card help you proactively prevent fraud and ensure your budget is spent appropriately. A prepaid debit card allows you to maintain control, locking or unlocking cards, setting custom controls, and even issuing instant transaction alerts to your phone or computer.

No Employee Reimbursements Needed

A prepaid debit card is not only beneficial for those everyday restaurant expenses. It can also help take a time-consuming burden away from your accounting team, by eliminating the need to reimburse employees.

A debit card can be a flexible alternative to your managers or employees spending their own money and getting reimbursed. Particularly if your employees are used to waiting for reimbursements, this shift can also boost morale.

In addition, moving to a card system means your restaurant doesn’t need to worry about replenishing the petty cash fund at each location.

Expense Management & Vendor Payments

Corporate debit cards can help you ensure your expenses are where they should be, but these cards can be used for more than just everyday expenses.

Your debit card can also be used for easy vendor payments. Instead of hand-coding expense reports and routing them for approval, before finally printing and mailing paper checks, a corporate debit card is a straightforward alternative way to pay. For virtual cards, you can issue these cards on an as-needed basis from within your card platform, without needing to wait for your bank to issue and mail.

And with a thorough digital trail, purchases made with your corporate debit card allow you proactively organize your expense management. Even if the receipt for a purchase doesn’t have individual line items, if you have proactively added a predetermined GL code to each card (one for kitchen, one for bar, etc), you can still organize your expenses. You already are more confident that the funds have been spent appropriately, and the digital documentation trail allows your back office team to quickly and accurately categorize and reconcile expenses.

Cash Back Options

Your debit card spend also comes with one very big bonus: cash back! The Ottimate Card offers restaurants the opportunity to earn up to 1% cash back on VendorPay when used to pay eligible vendors. Compared to the cost of manually printing and mailing paper checks, this small cash back bonus can add up over time to offer a significant boost to your business.

Pros & Cons Summary

Pros

- Quick and simple type of payment, particularly compared to petty cash or paper checks

- Convenient for everyday expenses and vendor payments (providing the opportunity to earn cash back on everyday purchases)

- Controls can be customized on the backend, placing spending limits or category specifications on individual cards to help place guardrails on expenses

- Can be used for purchases in-person, online, or over the phone

- Removes the need for an employee reimbursement process

- Can help you accurately and efficiently manage restaurant expenses

Cons

- Need to anticipate and set up backend controls ahead of time to be able to take advantage of them

- Need to be responsive in adjusting the card if purchasing is exceeding current limits

Corporate Card Case Study: Clutch Coffee Bar

Clutch Coffee Bar, a coffee stand company now eight locations strong and growing fast, is a Ottimate customer who has taken full advantage of the Ottimate Card. By combining the corporate card and expense management platform into one, the team could issue virtual and physical cards while controlling every parameter of the card use.

Most corporate cards out there didn’t work for us because of stringent cash balance requirements. Ottimate’s corporate debit cards are way simpler. I can issue one with a single click, control the card’s rules myself, and monitor all of my purchase activity in real time.

The Ottimate Card helped the company replace their previous petty cash system. By distributing physical cards to managers at different locations, the stores are able to use the card instead of cash for incidental expenses.

The virtual and physical card system allowed Clutch to obtain granular control and automation in their expenses process, all while scaling their team. The Clutch accounting team creates a card for every category of spend for each store, making a location-specific expense reporting system that is fully automated and helps ensure protection from fraud and vendor error.

Clutch Coffee also reported earning more than $5,000 in cash back over six months, just by paying their vendor bills.

Conclusion

While petty cash has long been common in the restaurant industry, corporate debit cards offer new features and functionality that can offer more peace of mind for owners and operators. With card controls in place, plus a simplified expense management process, your restaurant can take full advantage of a corporate card system to keep your business growing.

Ottimate’s Spend Management Solution, Spend Essentials, provides the tools you need to handle incidentals and other expenses without resorting to petty cash with none of the frills you don’t need. Book a demo today to learn more.

*Originally published January 2022. Updated October 3, 2024, for content and accuracy.