Welcome: You’re Already Approved.

The Ottimate Card opens the world of pre-approved spend to every business, employee, and expense.

For Controllers

Issue and edit cards on-demand to start controlling your spend before it happens.

For Employees

Enjoy all the convenience of a corporate card, anywhere you use a card.

For Everyone

With The Ottimate Card, any business can set up a corporate expense card program.

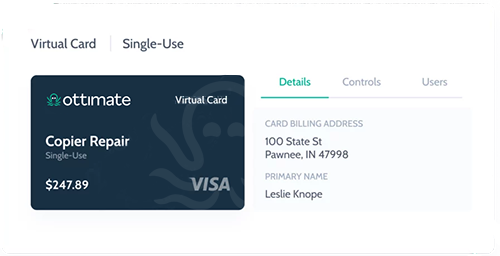

Issue Virtual and Physical Cards

Get Started With The Ottimate Card

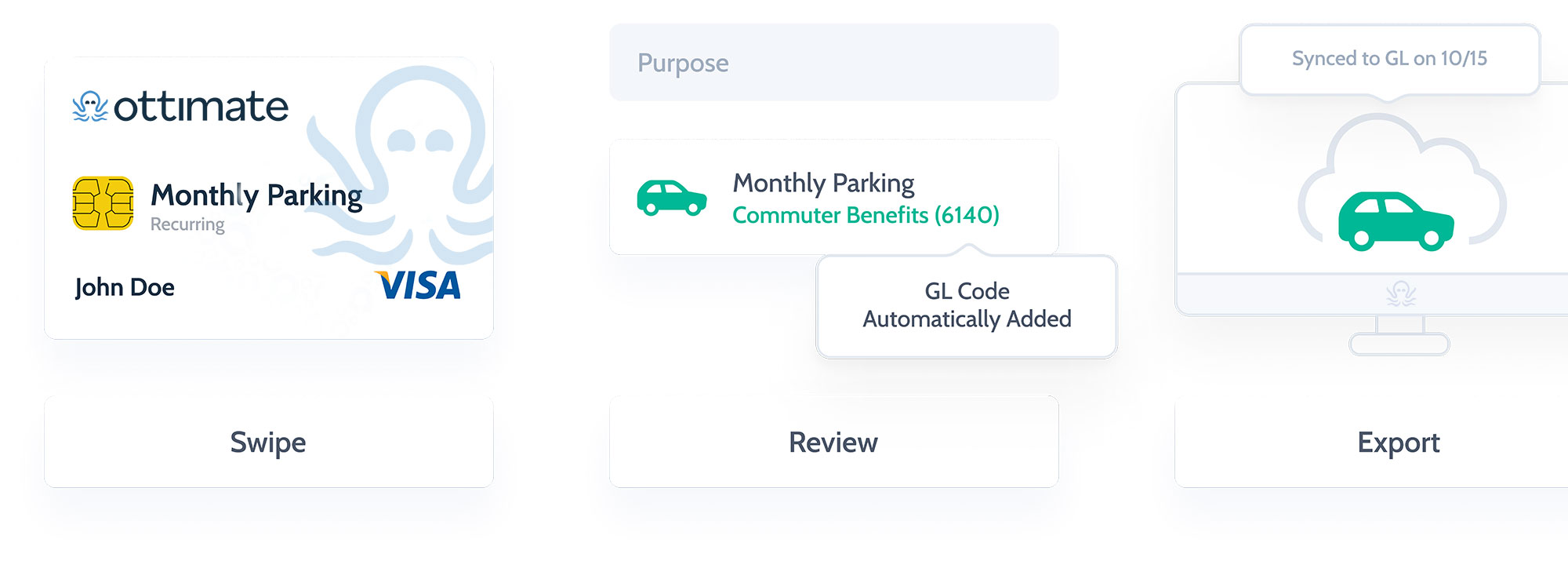

Code Transactions To Your Chart of Accounts, Automagically

Minimize manual data entry with AI-powered GL coding. Map each transaction to your chart of accounts once and Ottimate will remember it next time.

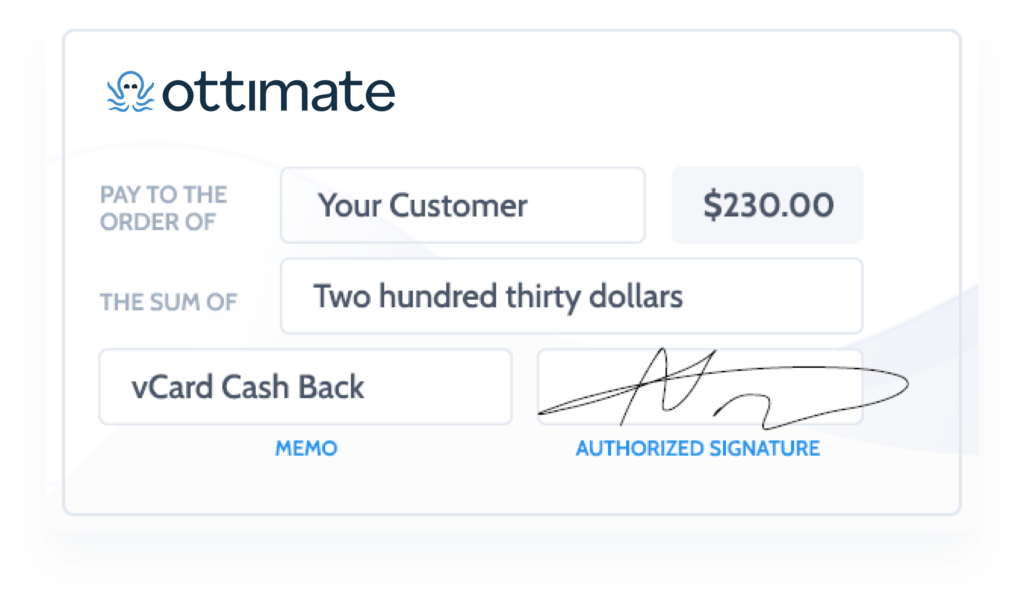

Expense Management That Adds Revenue

The Ottimate Card earns competitive cashback on every transaction. With no limit to the number of cards you can create, every employee and team can start earning for you today.

Issue Cards Instantly. No Bank Approval Needed.

The Ottimate Card is perfect for organizations looking to set up a card program for all employees without having to deal with prohibitive requirements.

- No minimum bank balance

- No credit check

- No personal guarantee

“Most corporate cards out there don’t work for us because of stringent cash balance requirements. Ottimate’s corporate debit cards are way simpler. I can issue one with a single click, control the card’s rules myself, and monitor all of my purchase activity in real time.”

Jake Vandermeer

CFO, Clutch Coffee

Reimburse Your Employees

- Review, approve, and reimburse cash expenses

- Send employees cash via direct deposit or vCard

- See all your card transactions on one dashboard

Spend Control À La Carde

With granular control over each card, controllers can feel good about issuing Ottimate Cards for every employee, team, department, and use case.

A Card for Every Occasion

Burner Cards: Single-transaction use. Great for one-off expenses.

Subscription Cards: Cards-on-file for recurring fixed expenses.

Reloadable Cards: Pre-approved for variable expenses like fuel or utilities.

Create Cards for Specific Merchants

Granular controls let you specify nearly every parameter of a card’s purchasing ability both before and after it is issued.

Subscription Cards: Cards-on-file for recurring fixed expenses.

Example: Be sure your office manager is using their virtual card for supplies by specifying which vendor can accept it.

Create Cards for Specific Categories

Merchant Category Codes (MCCs) control what types of purchases each card can make.

Example: Give your drivers physical cards that can only be used to make purchases in MCC category #5542: fuel pumps.

A Smarter Corporate Card

No more manually keying in card statements. The Ottimate Card uses AI, mobile technology, and mint-condition transaction data to streamline accounting.

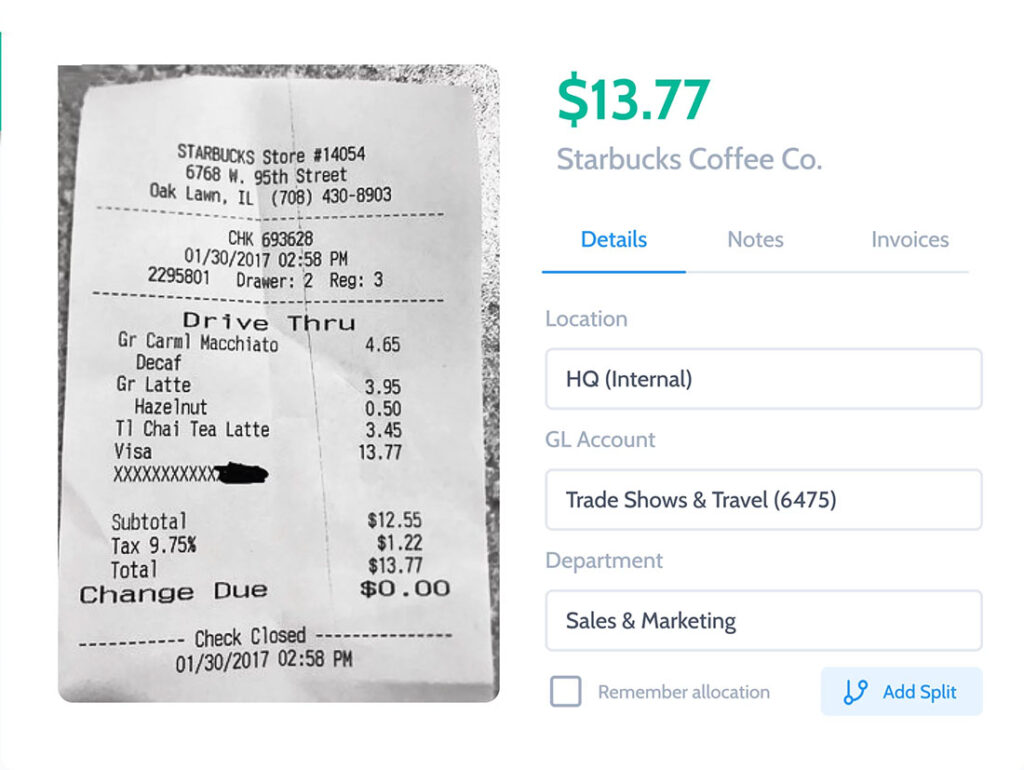

Easy Receipt Capture & Matching

Stop chasing your employees for receipts.

Convenient mobile capture and AI-powered receipt-matching help gather every receipt and pair it to its corresponding transaction.

Streamlined Accounting Sync & Reconciliation

Reclaim your end-of-month.

With accounting sync, GL mapping, and one-day settlements, The Ottimate Card minimizes manual data entry and ensures a smooth reconciliation process.

Automated Mileage Tracking

Make mileage reimbursements easy.

The Ottimate Card’s mileage tracker calculates distance and costs automatically, matches up receipts, and prepares a smooth cash reimbursement process.

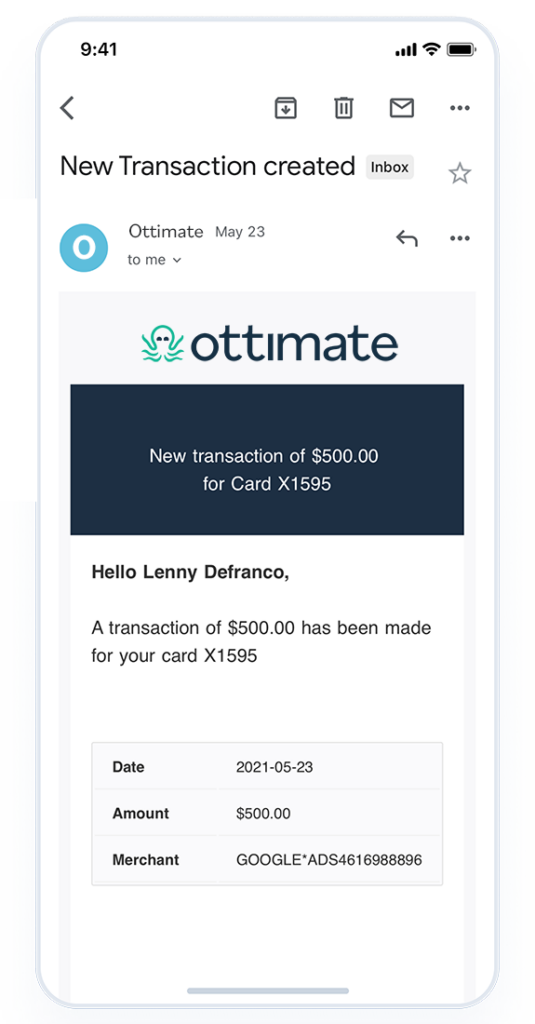

Instant Transaction Notifications

Stay in the loop and stay in control.

Set up email notifications on cards you need to monitor in real-time — and keep an eye on everything at once in Ottimate.

Ottimate Integrates With Your Accounting Platform

Seamlessly connect your expense data with the technology you’re already using.

See More

6 Ways Online Ordering Will Increase Restaurant Efficiencies