Streamlining the Approval Process: Your Guide to AP Approval Workflows

by The Ottimate Editorial Team

The approval process lies at the heart of accounts payable (AP) management. It helps ensure every invoice you receive is valid and error-free and that every payment you make is accurate, authorized, and timely.

But slogging through a manual accounts payable approval process can lead to errors and eat up too much of your team’s time — creating inefficiencies throughout the end-to-end AP workflow.

Luckily, you can easily transform your business’s invoice and payment approval flows through AP automation. Automation doesn’t just accelerate the approvals process; it reduces errors, boosts accuracy, and allows for better compliance and stronger audit trails.

Let’s explore the ins and outs of AP approval workflows and the role AP automation plays in them.

Automate Your Approval Process

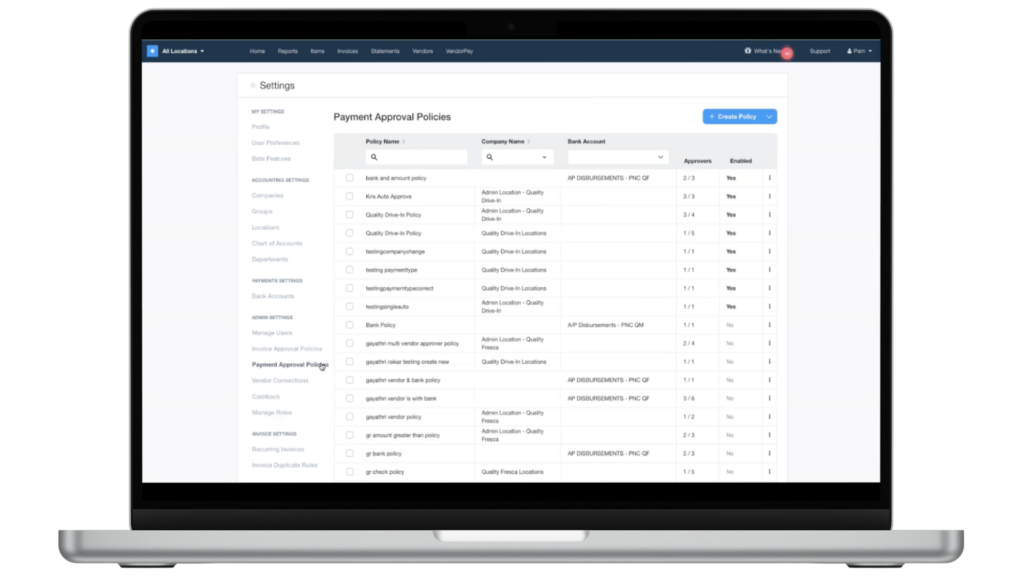

With Ottimate’s advanced workflows and approval policies, you can create automated workflows to route invoices and payments through custom approval policies that meet your business’s needs.

Understanding the Accounts Payable Approval Process

Approvals are an essential part of the overall accounts payable workflow, which generally includes the following steps:

- Invoice received and coded: An invoice is received from the vendor, and each line item is coded to the correct general ledger (GL) code.

- PO matching: The invoice is verified against a purchase order (PO) or receipt to ensure accuracy.

- Approval routing: The assigned approver(s) then reviews and approves (or rejects) the invoice and payment amount. If the invoice is rejected, it will need to be corrected or updated before payment can be made.

- Payment scheduling: Once approved, a payment is scheduled using the vendor’s preferred method of payment.

- Data entry and recordkeeping: Invoice and payment information is synced with your existing ERP or accounting system.

Businesses use approval workflows to verify and approve invoices before making payments. This process ensures all invoices and payments are accurate, legitimate, and authorized, safeguarding your company against fraud, errors, and duplicate payments. Approvals also help you stay compliant with both internal and external policies and regulations, helping you maintain financial integrity and steer clear of any legal issues or disputes with vendors.

Types of Approvals

There are several types of approvals, each of which addresses a specific need in your company’s workflow:

Benefits of Automating Your AP Approval Workflow

Many AP departments are still manually tackling each step in their end-to-end AP workflows, including how they approach approvals. This can create several challenges, such as:

- Delays: Manual processes often involve the physical transfer of documents, leading to delayed invoice approval and payment.

- Errors: Manual data entry is prone to errors, resulting in incorrect payments and financial discrepancies.

- Lack of Visibility: It can be difficult to track approval status in a manual process, leading to a lack of transparency and control.

- Compliance Issues: Manual recordkeeping can be cumbersome and challenging. Documents can be easily misfiled or even lost, making it difficult to audit and pull data needed to comply with regulatory requirements.

These issues can lead to late payments, strained vendor relationships, and increased operational costs — all of which reinforce the need for more efficient workflow solutions.

If your goal is to create a more streamlined AP approval workflow, look no further than AP automation. AP automation uses technology to enhance each step in the accounts payable process.

Advanced AP automation solutions, like Ottimate, use powerful AI and machine learning capabilities to do more than simply handle routine tasks like invoice capture, data extraction, approval routing, and payment processing. They can also learn your existing processes, helping you improve efficiency and develop workflows tailored to your business’s needs — making the entire process more streamlined, accurate, and transparent.

Automating the your accounts payable approval process offers several benefits that can greatly improve your AP workflow:

Better Efficiency and Speed

With automated approval workflows, you can avoid chasing down approvals in meetings or via email. Instead, payment requests are automatically routed to the right approvers and verified or declined with a single click. This helps ensure faster payments, improved cash flow management, and better supplier relationships.

Fewer Human Errors

Manual processes are prone to typos, miscalculations, and billing errors — causing issues like late or duplicate payments if left unresolved. But streamlining your approvals with AP automation makes it easy to pinpoint discrepancies and ensure payments are accurate and approved on time.

Some automated systems also include validation checks to detect and prevent errors before they occur, boosting visibility and accountability throughout the entire accounts payable process.

Greater Control and Transparency

Automated workflows give you up-to-date, easy-to-search digital records of all transactions, including approval activities. This helps boost your visibility and maintain compliance with internal approval policies and external regulations.

Stronger Compliance and Audit Trails

With the right AP automation solution, you can generate comprehensive reports and detailed audit trails that document every step of the approval process — from invoice approval to payment authorization.

Hear from Our Customers

Learn how automating the invoice lifecycle uncovered an unexpected benefit for Nivea Hospitality: a standardized approval process. “We didn’t really have an approvals process before Ottimate,” explains Nivea’s CFO, Vanessa Troyer. “But now we have just that one extra person looking at them and making sure that everything’s good. So that is good to have!”

5 Steps to Automating Your Accounts Payable Approval Workflow

Ready to automate your AP approval process? Here’s how to get started:

1. Evaluate Your Current Process

Begin by mapping out your existing invoice approval workflow. Identify each step in the process, from invoice receipt to payment, and document the roles and responsibilities of each person involved. This will help you understand the current state of your AP process and identify bottlenecks, inefficiencies, and areas for improvement.

2. Choose the Right Automation Tool

Next, you’ll want to research and compare different automation tools. Consider factors such as scalability, user-friendliness, cost, and features, and look for software that aligns with your business needs and long-term goals. Evaluate each option’s integration capabilities, customization options, and support services to ensure that the tool you choose can effectively support your AP workflow.

Choosing an AP Automation Solution for Your Approval Process

Choosing the right AP automation software for your needs can feel overwhelming. To help find the right solution, let’s break down the key features you should consider when evaluating AP automation tools:

3. Set Up Your Workflow

Once you’ve selected an AP automation platform, it’s time to get it up and running. Setup should include defining approval criteria and setting notification and escalation rules.

Consider the steps involved in your invoice approval process to guide you as you configure the approval hierarchy in your new software. Assign roles and responsibilities to the appropriate people and customize your workflow to reflect your organizational structure and policies.

4. Train Your Team

After everything is configured, it’s time to put your new workflow into action. This starts with providing comprehensive training to all team members involved in the accounts payable approval process. Training should cover more than just the new workflows and approval procedures; you’ll also want to make sure everyone understands the features and functionalities of the new system.

5. Monitor and Optimize

As you use your new workflow, it’s important to measure its impact by regularly tracking key metrics — like invoice processing-to-payment times, approval bottlenecks, and payment status — to identify areas for continuous improvement.

Encourage feedback from your team and make adjustments as needed to promote efficiency, effectiveness, and stronger overall performance.

Maintaining an Efficient Accounts Payable Approval Workflow

Choosing the right AP automation software for your needs can feel overwhelming. To help find the right solution, let’s break down the key features you should consider when evaluating AP automation tools:

Check out Ottimate’s Resources page to stay informed about the latest tools, best practices, and innovations in the field.

Automate Your AP Approval Workflows with Ottimate

An efficient accounts payable approval process is essential for maintaining financial control, improving cash flow management, and fostering strong supplier relationships. By automating your invoice and payment approval workflows, you can boost efficiency, reduce errors, improve accuracy, and achieve better compliance with internal and external policies.

Investing in an AP automation solution, like Ottimate, is the first step in creating an effective approval workflow.

Ottimate transforms your entire AP process, from invoice upload to vendor payment and beyond. Our AI-powered AP automation tools take your process to the next level, saving you time, money, and headaches. Ottimate helps you eliminate the obstacles of manual approvals and enjoy the benefits of a streamlined workflow.

Help your business drive operational efficiency and achieve long-term financial success — schedule an Ottimate demo today.