The A to Z of Accounts Payables, Explained

by The Ottimate Editorial Team

There’s a lot of information out there about accounts payables and the benefits of AP automation. However, none of it will really sink in if the reader doesn’t understand the terms being discussed or their implications. In this article we go over some of the commonly used terms in Accounting and Accounts Payable, so you’ll never have to fly blind again.

Pro-tip:

Bookmark this page so you can come back anytime to look up new terms!

A

Accounts Payable: Amounts due to suppliers relating to the purchase of goods and services on credit.

Accounting: A set of concepts and techniques that are used to measure and report financial information about an economic unit.

Accounting Cycle: The procedures needed to process transactions through an accounting system; including journaling, posting, adjusting, and preparing financial statements.

Accounting Equation: The equation behind the idea of balancing a business’s financial statements: Assets = Liabilities + Owners’ Equity.

Accruals: Recording of expenses incurred in a period for which no invoice or payment has changed hands by the end of that period. Accruals enable companies to be more accurate on their cash flow forecasts.

ACH: An automated clearing house (ACH) payment, is a form of electronic funds transfer sent from one bank account to another and can be either a credit or a debit. ACH payments are also US-based bank-to-bank transfers that are aggregated and processed in batches through the Automated Clearing House network, run by NACHA. ACH payments can be referred to as direct payments.

AI Machine Learning: Machine learning is a subset of artificial intelligence (AI) that provides systems the ability to automatically learn and improve from experience without being explicitly programmed. In ML, there are different algorithms (e.g. neural networks) that help to solve problems.

AP: Accounts Payable, a short-term debt that a company accrues when they purchase a good and/or service.

AP Automation: Technology to automate Accounts Payable processes, including e-invoicing, OCR, invoice matching, posting, workflow and supplier self-service. Automating payments, supplier statement reconciliation, duplicate identification, prevention and recovery as well as other sub-tasks can be automated.

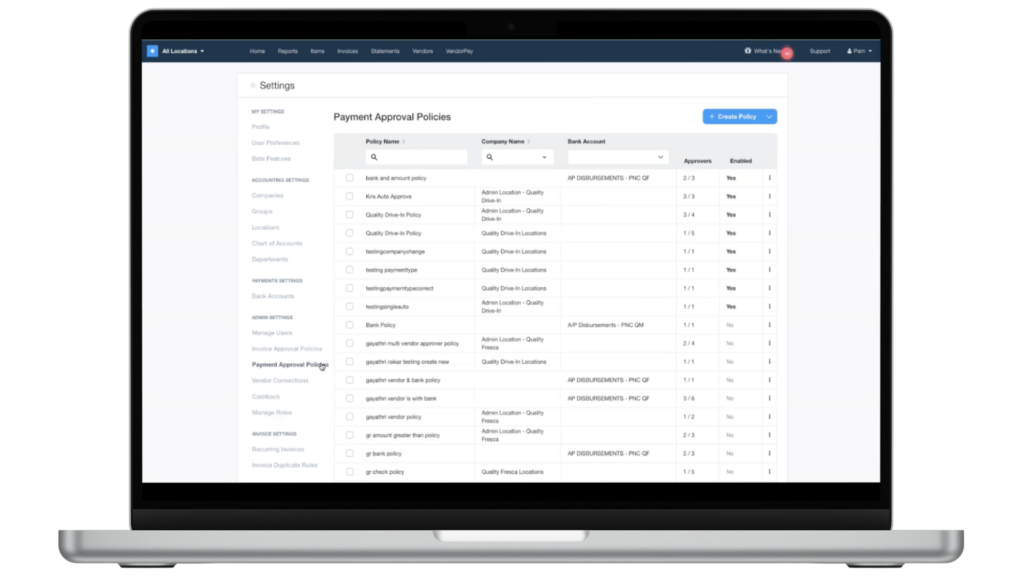

AP workflow: An electronic invoice tracking and authorization system that manages the entire reconciliation process, from invoice matching to approval and payment validation.

Asset: Tangible economic resources owned by a business entailing probable future benefits. Examples of assets are cash, equipment, inventory, real estate, and so on.

Audit: An objective examination and evaluation of the financial statements of a business to ensure that the financial records are a fair and accurate representation of the transactions they claim to represent.

B

Balance Sheet: a summary financial report stating the organization’s assets, liabilities, and shareholder or owner equity at the time of the report. Assets = Liabilities + Equity.

Back Office: an office or center in which the administrative work of a business is carried out, as opposed to its dealings with customers. Referred to as the BOH, or Back of House, in industries like Hospitality.

Bank Statement: A document received from a bank that summarizes deposits and other credits, and checks and other debits to a bank account.

Break-Even: The level of business activity where company revenues equal total expenses, producing a zero net income.

C

Capital: wealth in the form of assets or cash that show the financial strength of the organization, and the money that can be used for development or investment in a business to generate income.

Cash Flow: The incoming and outgoing of cash disbursements and receipts which represent the operating activities of a company. When the closing balance is higher than the opening balance, it is called positive cash flow, and the reverse is negative.

COA: Chart of Accounts, a list of accounts used as a basis for preparing financial reports in a business’s general ledger.

COD: Cash on Delivery, invoice must be paid upon receipt of the goods being purchased. This is generally made in actual cash but can also be a check if accepted by the vendor.

COGS: Cost of Goods Sold, the figure that represents the cost of purchasing raw materials used to produce the finished goods being sold by a business. In retail, the cost of goods sold is the purchase price of the merchandise. It can also be referred to as the cost of sales.

CPA: Certified Public Accountant; someone who has passed the Uniform Certified Public Accountant Examination. These professionals prepare financial statements, audits and reports such as revenue forecasts and profit margin analysis to help inform investors and business leadership about the financial health of organizations.

Credit: Any action in a chart of accounts that indicates an increase in liabilities, equity, and revenue or a decrease in assets, expenses, and dividends; usually right-justified in an entry.

Credit memo: A document issued by a vendor to a buyer that offsets a specified amount from an invoice, such as damaged/returned goods, lack of delivery, incorrect pricing, freight charges etc.. vendors usually apply a credit memo amount to a customers outstanding balances or issues the customer a refund.

D

Debit: Any action in a chart of accounts that indicates an increase in assets, expenses, and dividends; or a decrease in liabilities, equity, and revenue; usually left-justified in an entry.

Debit balance: Represents an expense for a company; in a general ledger account, represents a vendor’s debt owed to a company, which can occur as a result of returns, rebates allowances and chargebacks.

Deviation: A situation when an invoice differs from other documentation, such as a purchase order, contract of sale or delivery receipt. Deviations may include differences in the price or quantity of goods supplied.

DPO: Days Payable Outstanding, a business’s average time, measured in days, to pay invoices to suppliers, calculated on a quarterly or annual basis, indicating the effectiveness of the company’s cash outflows.

DSO: Days Sales Outstanding, the average number of days it takes credit sales to be converted into cash or how long it takes a company to collect its account receivables.

E

E-Invoice: An electronic invoice, usually a PDF, sent from a supplier via the Internet, which can be seamlessly integrated into a business’s automated accounts payable system, eliminating the need for a hard copy.

EDI: Electronic Data Interchange, the computer-to-computer exchange of business documents in an electronic format between business partners.

Equity/owner’s equity: The value remaining in a business after subtracting total liabilities from total assets. Equity can be positive or negative.

ERP: Enterprise Resource Planning, the integrated management of the core business process, usually in real-time and handled via updated technologies and software. The technologies provide financial intelligence, analytics, and visibility.

Expenses: costs incurred or money spent on a company’s efforts to earn revenue, which represent the cost of conducting business.

F

F.O.B Destination: Free on Board Destination; the seller incurs the freight charges and transfer of ownership of inventory occurs when the goods reach their destination.

F.O.B. Shipping Point: Free On Board Shipping Point; the purchaser incurs the freight charges, and transfer of ownership occurs when the goods are shipped.

Factory Overhead Budget: A budget that shows planned manufacturing costs needed to produce the planned production level within a period that are not direct costs (which are covered under the direct material and labor budgets). It’s usually split between variable costs and fixed costs.

Financial Statements: Reports that describe the financial condition of a company and the results of operations. These include statements like profit and loss, cash flow, and balance sheet.

FIFO: First-In, First-Out; an inventory cost flow assumption where the cost of goods sold is based on the earliest cost of those goods.

G

GL or General Ledger: General Ledger is a list of company accounts where different transactions are recorded; the central repository of all liability, asset, revenue, owners equity, and expense accounts of an organization that summarizes all financial transactions from subsidiary ledgers during a specific accounting period.

GAAP: Generally Accepted Accounting Principles, encompass the rules, practices, and procedures that define the proper execution of accounting.

GL-Code: A string of alphanumeric characters assigned to a financial entry in an organization’s chart of accounts, or general ledger. GL-codes indicate basic information such as a debit or credit by location or provide highly specific details about an entry through a GL String. They help accountants or bookkeepers reduce time spent entering data, quickly sort information, and prepare simple reports.

Gross Profit: Net sales minus cost of goods sold.

I

Invoice Data Capture: Scanning software is used for invoice data capture so suppliers can submit invoices digitally, or in their chosen format, and an organization can digitize and import the data into a uniform format, eliminating the need to enter invoice information manually. The result is a paperless accounts payable process with improved data quality by reducing the risk of data entry errors. Capture software may be used to validate invoice details per an organization’s pre-defined rules or requirements.

Invoice/AP Workflow: Collection and reconciliation of invoices, purchase orders, and approvals within an organization by the AP department. Invoices must be matched, approved, and validated for payment and reconciliation.

Invoice Matching: The AP process in which information on a supplier’s invoice is compared with relevant documents, such as a service contract, purchase order or goods receipt.

L

Liability: The debts a business owes to other businesses or creditors, including accounts payable, overdraft and credit card balances, and loans.

LIFO: Last-In, First-Out; an inventory cost flow assumption where the cost of goods sold is based on the latest cost of those goods.

Liquidity: The ability of a business to pay near-term obligations as they become due.

Lower Of Cost Or Net Realizable Value: The practice of reporting inventory at the lower of their cost or net realizable value.

Lean Manufacturing: A manufacturing philosophy where the focus is on trimming waste, standardization, speed, and quality, without compromising the customer experience.

List Price: The price of a good or service as displayed on a menu, catalog, or price list before any discounts are applied.

N

Net Profit: The excess or deficit of total gains and revenues as compared with total losses and expenses for an organization during a specific accounting period. Also referred to as earnings, net income, and net earnings.

Net Income: Revenues minus expenses within a designated period of time.

Net Loss: The excess of expenses over income within a designated period of time.

Net 15, 30, 90: These are credit terms on an invoice that indicate when full payment is due. Net means the amount to be paid includes any discounts, markdowns or vendor credits that were applied to the purchase.

Notes Payable: Short-term borrowings with a formal written promise to pay (promissory note).

Notes Receivable: Written promissory note from clients or customers to pay money due on a specific date in the future.

NSF Check: Non-sufficient funds check, also known as a bounced check. This happens when a customer’s check gets returned by the bank for lack of funds.

O

OCR: Optical Character Recognition; a system used by Accounts Payable to automatically extract invoice header and line item data from invoices received from suppliers by email or paper. OCR enables Accounts Payable to eliminate manual data-entry and enter invoices into the Accounts Payable ledger faster and more accurately.

Open Invoice Amount: An outline of the real-time status of invoices that have yet to be settled.

Operating Activities: Cash flow category generally related to transactions incurred in the process of generating income.

Opportunity Cost: The cost of an activity not done; this may include lost revenue, the time-cost, etc.

Outsourcing: Using an independent, external third party to perform services on behalf of the business, like manufacturing, data entry, data processing, payroll, or other business activities.

P

P&L: Profit and Loss, the financial statement summarizing costs, expenses, and revenues for a specific period of time, typically a year or fiscal quarter. Like the income statement, the P&L shows an organization’s ability, or inability, to generate supply by reducing costs, increasing revenue or both. The P&L statement is also referred to as a statement of operations or earnings statement.

Payment terms: Provisions regarding settlement of transactions agreement between the buyer and supplier.

Petty Cash: A modest fund set aside by the business to make small payments that are impractical to pay by check. Also known as an imprest fund.

PIA: Payment In Advance, made for goods or services before the items are delivered or the services are performed. For example, a buyer may be asked for an upfront deposit of 50% on a special order.

Payment on Time: KPI for Accounts Payable to measure performance of payments to payment terms agreed with suppliers.

PO: Purchase Order, a document created and submitted by a buyer which, when accepted by the seller, forms a legal contract between the parties that outlines the descriptions, prices, quantities, discounts, payment terms, date of shipment or performance, and other terms and conditions related to the transaction between the buyer and a named seller. For AP, invoices and purchase orders should be matched to ensure the business is being billed correctly, before payment is authorized.

Posting: The process of transferring journal entry effects into the respective general ledger accounts.

Prime Costs: the costs directly incurred to create a product or service. These costs are useful for determining the contribution margin of a product or service, as well as for calculating the absolute minimum price at which a product should be sold.

Q

Quick Ratio: A method to measure a business’s liquidity, calculated by dividing quick assets (cash, short-term investments, and accounts receivable) by current liabilities

R

Raw Materials: Unprocessed materials that are directly used in the production of goods sold.

Rebate: an amount of money which is returned to you after you have paid for goods or services or after you have paid tax or rent.

Recurring invoice: An invoice that’s sent to a customer on a regular schedule for a specific service or product.

ROI: Return-On-Investment; a metric is used to evaluate the value of an investment and is found by subtracting the cost of that investment from its current value, then dividing that by the cost of the investment. In most cases, ROI is expressed as a percentage. ROI can also be used to describe the time it takes for an investment to earn back the initial expense.

S

Supplier Statement: A summary of open invoices sent by suppliers to the buyer as a reminder for the buyer to check if there are any discrepancies to ensure both sides of the transaction have accurate records.

Source Document: A document that provides evidence of a transaction or event and drives the initiation of an accounting journal entry. Examples include invoices and receipts.

Statement Of Cash Flows: A financial statement that summarizes the business’s cash flow relating to operations, investing, financing, and non-cash investing/financing activities.

Step Cost: Costs that are fixed over a range, but then increase by a measured step to a new level when the activity being conducted increases to the next threshold.

Stock: Units of ownership in a corporation or business that are transferable.

T

Terms Of Sale: Payment terms that a company and its customer have agreed to in advance of the sale. The terms can include price, delivery date, quantity, payment method and payment terms.

Three-Way-Match: Validation of an invoice against purchase order and receiving document; price, quantity and goods received note are checked as part of 3-way-match.

Touch-less Invoice Processing: no manual input is necessary from the time the invoice arrives at an organization to the time it is posted to the ERP for final booking and payment. Touchless invoice processing is possible when the invoice is automatically matched against a supporting document, such as a goods receipt and purchase order or contract, and sent for payment without any human handling.

Timelines: allow your data and insights to be available to you as soon as it is capable of influencing your operations.

Trade Receivables: Money due from customers from sales of products or services that were made on credit.

U

Unearned Revenue: Revenue that is collected before goods or services are provided. Reported as a liability until it’s earned.

Unit-level Activities: Activities that are directly related to the production of units of output; each additional unit of production requires another activity.

V

vCard, Virtual Cards: Virtual cards are randomly-generated card numbers that allow you to use card payment portals with single-use or multi-use credit card numbers. They are generated digitally by the card issuer almost instantly and are designed to be entered into online purchase or checkout forms. Read more about vCards here.

Variable Costs: A per unit cost that is the same regardless of volume; total variable cost increases with volume increases.

Variances: Deviations from the norm that may provide warning signs of situations requiring corrective action by managers.

Verifiability: A system of accounting such that different knowledgeable and independent observers reach similar conclusions based on audit trails, time-stamped entries, and documentation that matches inputs into the accounting system.

W

Weighted-Average Inventory Method: Under the periodic inventory system; inventory cost is based on the average cost of units purchased giving consideration to the quantities purchased at different prices. Read more about inventory costing methods here.

Weighted-Average Process Costing A process costing technique where all units of production are assigned the same cost; determined by blending of current period costs with beginning inventory cost. Read more about it here.

Working Capital: The difference between current assets and current liabilities.

Write-Off: A reduction in the recorded amount of an asset. A write off occurs when an asset can no longer can be converted into cash, provide no further use to a business, or has no market value.

Z

Zero-Based Budgeting: A budget approach where each expenditure item must be justified for each new budget period.