How Cost Validation Helps Grocers and Retailers Prevent Misspending, Preserve Profit Margins, and Control Costs

by The Ottimate Editorial Team

In the grocery and retail industry, costs are high and profit margins are low. The trouble is that all too many companies end up losing money when the prices on vendor invoices don’t match what they expected to pay. In this article, Ben Spiegel, Ottimate’s growth product manager, shares how cost validation tools in an AP automation suite are helping stores overcome this issue, minimizing misspend, ensuring that the right product types and quantities are delivered, and protecting profit margins.

Why can mismatches between quoted and invoiced prices create issues for grocery and retail stores?

75 percent of independent grocers surveyed in 2023 indicated a net profit margin of about 1.7 percent, which was down from 2.5 percent the year before. Almost 70 percent of operational expenses for a grocer are the cost of goods they put on their shelves, so it’s critical that they carefully manage what they pay for perishable and non-perishable items. When we started selling into retail and grocery, we discovered a product gap in our core technology, which captures a physical invoice or digital invoice image, applies dimensions, and pushes it into an ERP system.

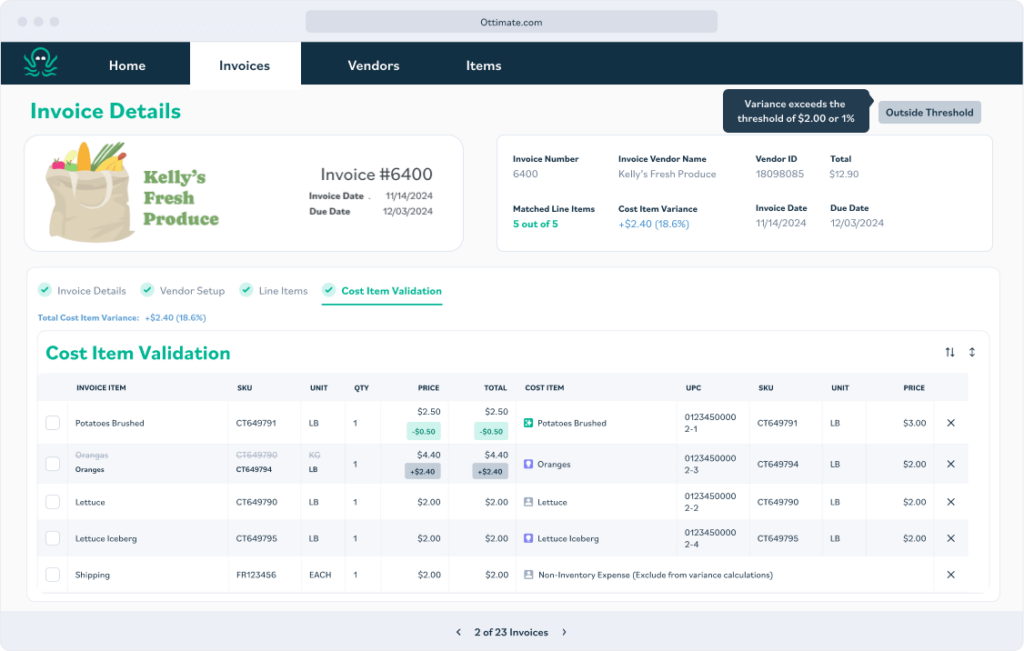

Just facilitating payment wasn’t sufficient because grocers and retailers also required assurance that the prices vendors were charging them on invoices matched their expected costs. Those prices are managed in a separate POS or store management system and overseen by a merchandising or purchasing team. There was a need for a middleware product that bridges the technical and communication gaps between procurement and finance. We built a cost file validation tool that matches the expected cost of items to the invoice pricing that the vendor is charging so that when an AP clerk or finance lead pays the bill, they can be assured that both the cost of every item on it and the sum total matches what they intended to pay.

What about cost validation for other types of transactions, and how would you compare and contrast that to the solution you just spoke about?

The cost file validation tool I mentioned is the perfect solution for invoices that are received in the absence of a purchase order or other procurement documentation. The PO Match feature that Ottimate offers does a similar thing but performs either a two-way match between an invoice and PO or a three-way match that also includes a receipt. For customers like Heritage Grocers Group, this improves the receipt reconciliation flow and checks for variances in price, quantity, item type, and more so that if the PO and/or receipt don’t match the related invoice, a staff member is alerted. The difference between these solutions really comes down to the customer profile.

A grocer or retailer that has the capital and labor resources to invest in a comprehensive procurement solution that involves scanning delivery receipts when receiving goods and reconciling them and POs against invoices with a high level of granularity is generally an upmarket client. A larger grocery or retail client or one that’s scaling from one to five stores to have a more regional presence needs to be assured that they’re evaluating the quantity, unit of measure, and expected cost of the items that are coming in prior to signing off on each invoice.

The cost file validation tool provides the same level of assurance as the PO Match product but without needing a scanning solution or paying people to be at the loading dock to scan barcodes on every pallet that comes in. You’re still going to capture any overbilling or overcharges that the vendor’s putting on the invoice prior to paying it and will also know if a vendor hasn’t honored a discount or allowance that was posted in the POS system.

Cost file validation is a solution for managing payments to DSD vendors, which stands for direct store delivery. The majority of grocery goods come from wholesalers. They take products to a warehouse, and then the grocery company’s staff delivers them to individual stores. 35 to 40 percent of a grocer’s purchases come from DSD suppliers who go to stores one by one and deliver their goods to the back door.

If they’re a smaller vendor, they might not be updating their prices regularly or communicating those changes, so there can be mismatches between expected costs and what’s being invoiced for. An independent grocer typically doesn’t have the staffing to manually check every line item, so they could be overpaying – which eats into their margins – or overcharging, which could impact sales. Using AI and machine learning, the cost file validation tool will identify these issues before payment.

We talked about how valuable this and the PO Match tool are for grocery and retail companies of every size, but they’re industry agnostic. Gas stations and convenience stores could also benefit from cost file validation. If a pharmacy’s drug distributors send them a price list, they could leverage Ottimate’s AI-driven matching to compare the quoted cost price of each medication to what’s on the vendor invoice and it would highlight any mismatches.

Are there any other challenges that Ottimate’s cost validation tools help grocery and retail companies solve?

They can also catch underbilling. If your POS price is artificially high, you might have bad data in your system, which can prompt the merchandiser to look up the actual costs and update their system. Grocers also struggle with empty shelves, which can affect gross margin and sell-through on specific items. Exposing potentially unauthorized substitutions and new items – whether for different packs or different products altogether – is really important.

On top of that, you can also handle unit of measure mismatches, so if a product is delivered with the incorrect configuration, Ottimate’s PO Match feature will catch that variance. If you have negotiated pricing for an entire grocery store group, Ottimate helps you standardize that and ensures that store A is getting the same prices as stores B and C. It also helps confirm that POS system pricing is correct so that you’re achieving target gross margins on every invoice. Our cost validation solutions drive down overcharges, increase the profit margin on the goods that grocers sell, and ensure data quality and consistency.

Given how significant the purchases of larger grocers are, it’s clear why reducing misspending can save them a lot of money. But why might the cost file validation and PO Match features in Ottimate also help small to midsize grocery companies?

A small co-op or mom-and-pop grocery operation may have several hundred vendors, with each offering different pricing and ways to communicate that. These kinds of grocery businesses may have limited resources for their merchandising teams to ensure that their actual costs are in line with what’s in their POS system. Each POS item has an expected cost, a gross margin, and an end user sale price. Keeping that data up to date and current is a challenge, and validating vendor costs against what you expect to pay to ensure that your sale price is not out of sync is especially difficult as you scale.

Many grocers don’t have the bandwidth to invest in a separate technology to validate pricing, as the costs both on the CapEx and labor side may be too onerous. So they forego the potential margin capture or recapture, believing that the amount they could save is less than what it would cost them to take action on it. Ottimate solves this problem.

Contracted pricing with vendors and specific stackable discounts or allowances are important, and so cost changes can be especially pronounced when you scale from one store to 20. When you look at the sell-through on a product at scale, the potential loss of margin is magnified. Ottimate’s cost file validation and PO Match tools don’t only expose any vendor malfeasance on pricing but also ensure that your cost files are kept up to date.

Ready to see how Ottimate can solve your company’s AP challenges? Book your demo now!

And check back soon for part two in this series, in which Ben will dive into how AP automation technology speeds invoice processes, streamlines payments, and expedites month-end closing.