Spend Visibility, Statement Management, and Vendor Relationships

by The Ottimate Editorial Team

Improving Spend Visibility, Statement Management, and Vendor Relationships with AP Automation (Don Dittmar Part 2)

In the first part of this series, our Vice President and Head of Product Don Dittmar revealed how Ottimate began in the restaurant industry, expanded into grocery, retail, and other areas, and created specific AP automation solutions for those spaces. Now in this second installment, Don shares how Ottimate highlights out of program spend visibility, reduces the risks of processing paper invoices, and learns user behavior to make predictive suggestions.

OTTIMATE: What is a typical customer’s AP process prior to using Ottimate?

DON DITTMAR: We started by working with small businesses, and almost all of them were handling paper invoices. They keyed in the details and passed them around to get approvals. It was hard for them to understand their costs and identify and fix issues. We still work with some of these small customers, as well as midsize and large organizations. Most of them typically utilize some sort of manual process.

Many companies have bought all-in-one operations software or ERP systems but haven’t gotten what they need from the payables and payment automation features in it. That’s why they come to Ottimate. There are also displacements of an old, document-centric kind of AP automation. We see some more sophisticated processes in large enterprise customers, but most others still rely on a highly manual or very lightly automated process, which is why Ottimate can make such a big difference.

OTTIMATE: What are some typical pain points within traditional AP workflows?

DON: There’s a high workload when you have to process invoices and other financial documents manually, and Ottimate removes the grunt work. The bigger pain point comes from missing information. It’s a high-risk process when you’re passing invoices around. For example, when I was at a previous company, we had a small invoice that we were supposed to process manually and it got lost, so payment wasn’t timely. The vendor interrupted service for us on Black Friday, which shows that mishandling even a small invoice can be very impactful. If there are thousands of invoices, the risk increases.

It’s equally important to have visibility into spending. If your company issues accurate POs, you know what you’ve intended to spend but might not be effective in matching that with your real outgoings. You end up with open commitments and things that are expensed elsewhere, so there are duplicate costs. Or you might have last minute buying and invoices that don’t get posted in the right period. All this clouds the visibility to your spending. The biggest thorn in the side of procurement is often out of program spending that happens through AP with manual processes. When Ottimate takes away the risk and increases visibility to spending, that’s a big win.

OTTIMATE: How much manual work was a typical customer doing prior to Ottimate?

DON: Many of our restaurant customers close on Mondays because they’re open on weekends. Some used to spend it processing invoices instead of it being a day off. A lot of our midsize organizations have disproportionately big AP departments because they don’t have a better way to get things posted and paid. It’s a significant amount of work, not to mention research for audits, chasing down costs, or preparing budget reports.

Automating AP creates knock-on effects like finding buying inefficiencies and with treasury, creating time for better vendor negotiating and contracting. Customers find value-add work instead of spending all their time on intensive labor.

OTTIMATE: What are some other common challenges that Ottimate addresses?

DON: One problem we solve really well with Ottimate’s machine learning engine is statement management. Vendors send customers not only invoices, but also statements with the same invoice subtotals on them. They’ll even use creative terms like “statement invoice” to try to get a customer to pay a sum total amount and clear some AR. Ottimate processes a statement as an actual statement and looks up individual invoices to see what has or hasn’t been paid.

It also applies machine learning to be predictive with those statements and gets better at identifying problem items. If an amount is floating, it might recommend creating a new invoice for it. Ottimate improves vendor communication through our portal too. During the payment process, it can let them know what’s being paid and when they can expect cash, credit card, ACH, or check payment. Ottimate also reduces the amount of time spent on setting up new vendors, discontinuing old ones, and answering calls.

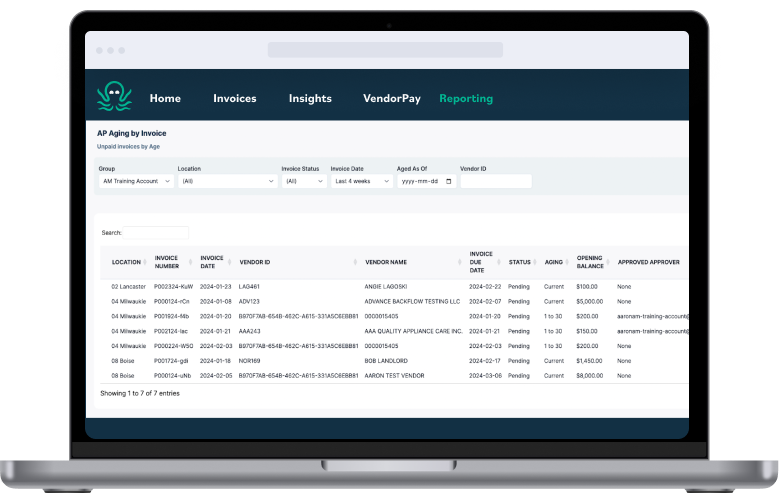

Spend visibility is also key, as treasury and AP automation are closely linked. Ottimate shows the costs and the cashflow hits that might be coming in any given invoice process, which contributes to the big picture. It’s not just about getting invoices processed so they’re paid quickly and accurately, but also adding value to the actions on the edges of that.

OTTIMATE: How often does Ottimate replace a similar tool versus it being a customer’s first time using AP automation?

DON: We replace an existing specialized product around 20 percent of the time. Many other customers are trying to use a tool that wasn’t really designed for AP automation – like their ERP system – that allows them to do basic things such as data extraction. They might have a third-party product for that alongside their operations platform, but often it’s still pseudo automation that isn’t working well for them.

Some customers switch from an all-in-one procurement tool that’s meant to focus on buying behavior, sourcing vendor pools, and contracting. They’re good at negotiating and creating purchases, but even though they’re marketed as complete procure-to-pay systems, AP automation is just an add on. Whereas for Ottimate, it’s our specialty. So when someone brings us in, they’re getting one A-plus instead of three C-pluses. We want to do our part well with payables automation, read into our customers’ data and workflows, and add predictive value.

OTTIMATE: How long is a typical customer looking for a solution before they find Ottimate?

DON: There’s a range that increases with the size of the organization. An enterprise company has lots of plumbing and wires to connect and more complex processes, so it could take years to even know that they need AP automation and how it could be applied. For a mid-market business, it’s typically around six months. When a smaller customer is fully manual and wants to optimize their process rather than replace existing software, they move quicker. Three to six months is fairly typical for recognizing the need, understanding what they want to do, meeting with vendors, and moving forward.

OTTIMATE: Do multiple departments often use Ottimate within an organization?

DON: Yes. The primary power users are in payables, payments, and purchasing. Accounting staff will look at invoices a year later for audits, and tax professionals need Ottimate too. Operational departments use it to examine their invoice flow, understand where they’re spending, and see how it relates to budgets. Executives and managers view reports and make approvals. Store personnel might have a spend management situation like needing to reimburse a driver for a petty cash disbursement. There can be users across the company.

OTTIMATE: What benefits do users report when they initially implement Ottimate?

DON: Predictive features are valuable when Ottimate starts to learn your data and suggest actions because it has patterned your information and users’ behavior. That’s when you see advantages in speed, throughput, and insight. If you’ve coded an invoice as office supplies 10 times and it’s the same criteria, then it’s probably office supplies again. We can match invoices to POs, allocate lines, and see how you’re spending. After a year of invoices passing through, your data model will have been constantly learning and improving, so it’s even better.

OTTIMATE: What are some wins for organizations transitioning from manual or lightly automated processes?

DON: They won’t miss payments and discounts or have poor vendor relationships where people are calling to see when invoices are going to be paid while you’re trying to work on other things. That saves a lot of time. Visibility is the second benefit. CFOs start noticing things in their buying process that they had no way to see before, such as out-of-program spend, approvals taking too long, or a vendor’s terms being incorrect.

Ottimate’s automation only brings people the data they need to see. If something has run through the system and matched all but one value, the user will only be presented with solving that problem. It’s less detective work and more quality control. Daily users feel like their workload has dropped, so they can focus on anomalies and exceptions. It makes them into true knowledge workers instead of button pushers.

Good AP automation blurs the line between purchasing and payables, connecting the people who initiate purchases and those who pay for them. You become more aware of buying trends, patterns, and pricing, which encourages critical thinking and solving business problems instead of just finishing work as fast as possible to get invoices paid. Does this price look right? Why is our vendor billing the wrong unit of measure? How come these prices don’t match our catalog? With Ottimate, you can ask and answer these questions that you didn’t have time for previously.

Want to see Ottimate in action? Schedule a convenient demo!

Check back soon for the final part in this series, in which Don will explain how Ottimate helps achieve financial goals, why next-generation reporting benefits senior leaders, and what’s next in AP automation!