Understanding Key Accounts Payable Metrics For Better Operational Efficiency

by The Ottimate Editorial Team

Accounts payable (AP) plays an important role in your company’s financial health. And keeping track of accounts payable metrics that provide valuable insights on operations and spend can help pave the way for sustainable growth.

So, which metrics should you focus on to improve your AP efficiency?

In this post, we’ll explore five metrics that can help you identify inefficiencies in your AP process — leading to more on-time payments, better cash-flow management, and a happier, more productive team.

Why Should You Track Accounts Payable Metrics?

Gaining access to real-time AP insights can provide a comprehensive view of your day-to-day operations and highlight areas of optimization. But beyond improving operational efficiency, tracking the right AP metrics can also provide the following benefits:

Improved cash flow management

Your company’s cash flow — or the movement of money in and out of your business — is a strong indicator of its current and future financial performance. By monitoring the right accounts payable metrics, you can analyze and optimize your financials regularly to achieve, and sustain, a positive cash flow.

Better vendor relationships

When you have granular insights into your AP operations, you can ensure vendors are paid on time and according to their terms. Conversely, keeping a pulse on certain accounts payable metrics can help you identify issues or bottlenecks that may impair vendor relationships if left unchecked.

Strategic decision making

Real-time data insights fuel informed, data-driven decision-making, empowering you to optimize processes, identify trends, mitigate risks, and capitalize on growth opportunities. With these metrics on hand, you can execute your AP process with precision and efficiency and support your company’s long-term financial health.

Key Accounts Payable Metrics to Drive Efficiency

The following accounts payable metrics will help you gain visibility into your AP operations to build a faster, more accurate end-to-end process.

1. AP aging or Days Payable Outstanding

Accounts payable aging is arguably one of the most important AP metrics, representing the total outstanding payments owed to vendors for a specific accounting period. Equally important, it can help shed light on existing or emerging payment trends — like the average time it takes to pay vendors, or Days Payable Outstanding (DPO).

The formula for calculating DPO is as follows:

DPO = (Average Accounts Payable / Cost of Goods Sold) x Number of Days in Accounting Period

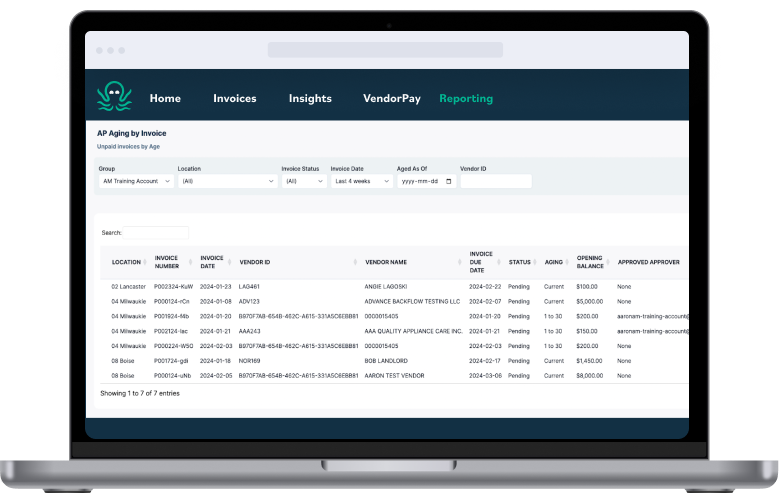

To better monitor outstanding payables and maximize opportunities to pay vendors on time, consider using an AP automation solution with advanced reporting capabilities that automatically generates AP aging reports.

With this report, you can view all unpaid invoices by their aging bucket — including invoice approval status and outstanding balances for specific locations and vendors — allowing you to identify payment patterns and ways to reduce late payments. As a result, you’ll save costs, improve vendor relationships, and ensure consistent cash flow.

2. Average processing time per invoice

How long does it take to process a single invoice, from beginning to end? For most AP teams, it takes 10.1 days, according to a recent report by Ardent Partners.

Your number may be higher or lower, depending on whether you use manual or automated processing methods. But understanding your team’s average invoice processing time empowers you to optimize your process to reduce this metric and, ultimately, reduce overall costs.

Here’s how to easily calculate your average processing time per invoice:

Average Processing Time Per Invoice = (Time Spent Processing Invoices / Number of Invoices Processed)

Some AP automation solutions provide a comprehensive view of your entire invoice lifecycle and the time it takes to move through each stage. In Ottimate, for example, users can access an Invoice Cycle Time report, detailing the time it takes to complete certain tasks, like verifying, approving, and exporting invoices.

Stay informed with real-time Accounts Payable metrics & reports

Boost visibility into your operations and spend and make better business decisions with instant data reports. By tracking accounts payable metrics over time, organizations can identify trends and make informed decisions about future investments.

3. Average spend per item or SKU

Understanding how and where you spend your money is a no-brainer. But regularly analyzing expenses at an item or SKU level can unlock actionable insights that help improve your AP operations.

To understand your average spend for a specific item or SKU, simply record the expense over a certain period and calculate the average. Alternatively, you can prepare a spend analysis report, providing a comprehensive view of current and historical spending for multiple general ledger (GL) accounts).

This information not only helps pinpoint inefficiencies in procurement, inventory, and supplier management. But it also uncovers opportunities to cut costs, improve sourcing, and renegotiate vendor contracts to attain more favorable terms.

4. Invoice exception rate

Invoice exceptions — like data entry errors, digitization errors, incorrect amounts, and purchase order (PO) mismatches — could be slowing down your AP process. Tracking your invoice exception rate can provide valuable insight into your process accuracy and efficiency.

Consider this: The average invoice exception rate is 22.5%, meaning one in four invoices require additional processing or manual intervention. And according to the American Productivity & Quality Center (APQC), it takes an average of four days to resolve an invoice error. Understanding this AP metric can help you hone in on a potential bottleneck and find solutions to optimize your process for accuracy and speed.

Here’s the formula for calculating the invoice exception rate:

Invoice Exception Rate = (Number of Invoices with Exceptions / Total Number of Invoices*) x 100

*Aim to use a large sample size of at least 100 invoices for a more accurate value

Keep a close eye on your invoice exception rate to keep errors in check and, thus, improve your AP efficiency.

How Cherry Lane saved time & money with AP accuracy

Our bookkeepers used to spend time picking up invoices, taking them to their office to do the work, and then dropping them off with checks for us to mail them when they were finished. Neither bookkeeper has been on location since we got Ottimate. So we’ve gained accuracy and are saving time and money on our bookkeeping as well. That’s a win-win.

Joan Gillcrist

Cherry Lane Ventures

5. Average approval time

Securing approvals is a common bottleneck in the AP process. And gaining visibility into this accounts payable metric can help you monitor approval efficiency and identify any bottlenecks in your approval process.

Like the other accounts payable metrics, an end-to-end AP automation solution is the easiest way to track your average approval time. Ottimate, for example, generates an approval aging report to show pending approvals by users. The report also provides granular data, including the approver’s name, outstanding invoice amount, and days delayed, to single out the exact holdup in the process.

With this information, you can revise your approval policy — and build custom approval workflows within your AP automation tool — that help reduce common delays and ensure invoices are approved on time.

Best Practices for Improving AP Efficiency

Yes, regularly reviewing and analyzing accounts payable metrics is one way to ensure your AP process is working efficiently. But there are other ways to reduce inefficiencies — like invoice exceptions and delayed approvals — or eliminate them altogether.

Automate your AP process

AP automation streamlines the entire lifecycle of an invoice with minimal human intervention. And with the right AP automation software, you can capture, code, approve, pay, and reconcile invoices in a few clicks — with guaranteed accuracy and speed.

Otti AI works overtime, so your team doesn’t have to

Why add Otti AI to your team? Backed by decades of data from the brightest minds in finance, Otti AI takes tedious tasks off your team’s plate to arm them with the info they need to make smart decisions — because AP should be fun, not frustrating!

Optimize your payment mix

If manual payments are burdening your AP process, it might be time to rethink your payment mix. While paper checks are still a popular way to pay bills and manage expenses, cutting multiple checks per vendor per invoice can be taxing and time-consuming.

By adding payment types like virtual cards (vCards) and Automated Clearing House (ACH), you can automate payments and even earn cashback — ensuring vendors are paid on time while adding to your bottom line.

Invest in ongoing staff training

Accounts payable is more than processing invoices and making payments. You’re also expected to know the latest financial regulations, manage vendor relationships, identify threats and risks, maintain organized records, and yes, analyze accounts payable metrics. By continuously improving these key skills, you and your team can effectively speed up your end-to-end AP process without sacrificing accuracy.

Renegotiate vendor contracts for better terms

Depending on your relationship with your vendors, there may be an opportunity to renegotiate your contract to achieve mutually beneficial terms. Beyond pricing, consider renegotiating payment terms, early payment discounts, order fulfillment speed, or minimum order quantities (MOQs). This strategy can drive more efficiency while also improving your cash flow.

Gain Access to Real-Time AP Insights with Ottimate

Accounts payable metrics help boost operational efficiency by identifying potential bottlenecks and illuminating areas of improvement. And if your goal is to build a more efficient AP process that runs like a well-oiled machine, then it’s crucial to monitor these metrics regularly and use the insights to adjust your process accordingly.

Unlock Valuable AP Insights for Your Business

With Ottimate, you’ll not only tap into best-in-class AP automation AI to supercharge your end-to-end AP process. But you’ll also gain access to detailed AP reports designed to help you derive real-time insights, optimize your process, and manage your cash flow better.